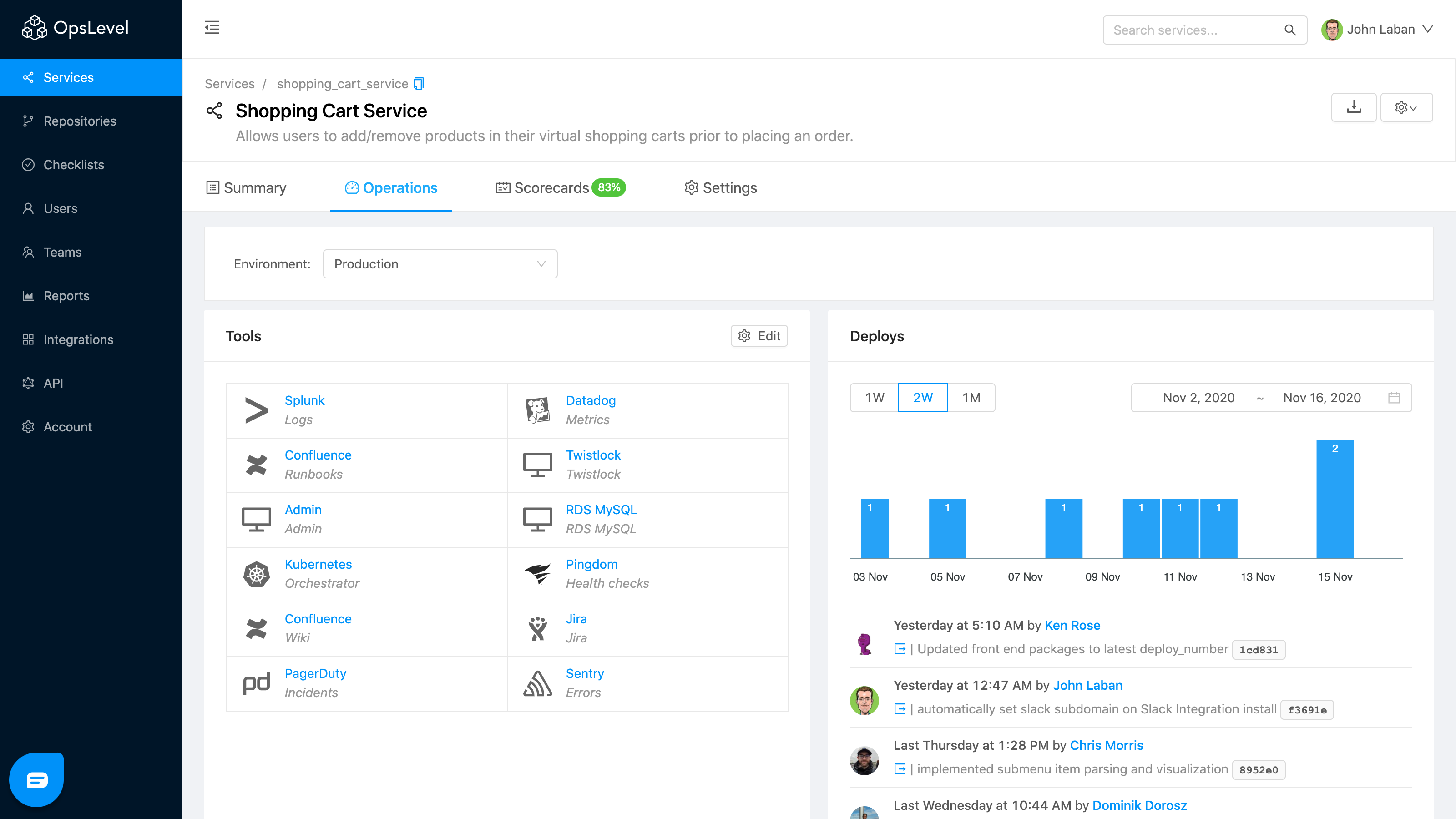

Bitcoin’s Impressive Rally: Key Insights

Bitcoin has surged approximately 16% in the past week, reaching over $18,000—its highest level in recent months. This upward momentum highlights the cryptocurrency’s resilience amid market fluctuations.

Recent Performance Highlights

- Current Value: $18,000+ (as of this morning)

- Weekly Gain: ~16%

- All-Time High Market Cap: Aggregate value of mined Bitcoin hits record levels (CoinMarketCap)

Source: YCharts (Note: Slightly delayed data; directional reference only)

Behind the Rally: Key Factors

- Miner Revenue Trends: Despite recent gains, Bitcoin mining revenue remains below historical peaks (Blockchain.com).

- Market Sentiment: Growing institutional interest and macroeconomic factors may be driving demand.

- Long-Term Viability: The rally reinforces Bitcoin’s staying power despite its notorious volatility.

Challenges in the Crypto Landscape

While Bitcoin thrives, other trends are reshaping the market:

- Ethereum’s DeFi Dominance: The decentralized finance (DeFi) boom is largely Ethereum-based, leaving Bitcoin out of this demand surge (DeFi Pulse).

- Adoption Metrics: Unique Bitcoin addresses haven’t shown significant growth, raising questions about broader usage (Blockchain.com).

The Bigger Picture

Bitcoin’s rally underscores its role as a store of value, even as its utility beyond speculation remains debated. For investors, the key takeaway is clear: volatility persists, but Bitcoin continues to command attention in the evolving financial landscape.

Data sources: CoinMarketCap, YCharts, Blockchain.com