How a Toxic Cap Table Can Kill Your Startup’s Funding Potential

A startup’s capitalization table (cap table) is more than just an ownership ledger—it can make or break future investment opportunities. A recent case study from a Norwegian hardware startup reveals how poor cap table management can render a company virtually uninvestable.

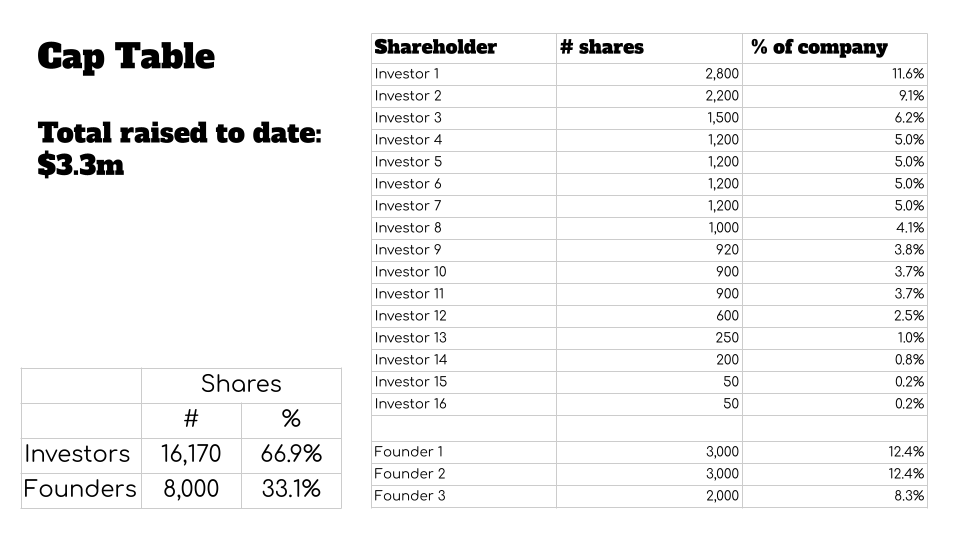

The Red Flag Cap Table

During a pitch review, TechCrunch encountered a startling cap table slide showing:

- Founders collectively owning just 33%

- Investors controlling 66%

- $3.3 million raised for over two-thirds equity

Image Credits: Haje Kamps/TechCrunch (simplified and anonymized)

Image Credits: Haje Kamps/TechCrunch (simplified and anonymized)

Why This Structure Frightens Investors

1. Founder Incentive Problem

“When investors own twice as much as founders combined, it’s a giant red flag,” says Leslie Feinzaig of Graham & Walker. “I want founders to have unquestionable motivation to keep pushing through the startup grind.”

2. Limited Exit Potential

Early over-dilution often leads to:

- Premature exits

- Mediocre returns

- Reduced angel investment activity

- Lower VC fund performance

3. Ecosystem Consequences

As Hunter Walk of Homebrew explains: “The whole VC model depends on potential for outsized returns. When that disappears, so does funding for the entire startup ecosystem.”

How Startups Land in This Trap

The Norwegian CEO (who requested anonymity) shared their path to this precarious position:

- Inexperienced Team: Corporate veterans unfamiliar with startup norms

- Short-Term Thinking: Accepting bad terms “just for this round”

- Development Delays: Forced to accept increasingly unfavorable terms

- Local Market Dynamics: Limited access to experienced startup investors

Potential Solutions for Recovery

Cap Table Restructuring Options

Investor Cram-Down

- Aggressively rebalance ownership toward founders

- Requires strong lead investor support

Founder Equity Grants

- Mary Grove of Bread & Butter Ventures suggests:

- Target 50-75% founder ownership at seed stage

- Existing investors must accept dilution

- Mary Grove of Bread & Butter Ventures suggests:

Pre-Funding Cleanup

- As Walk advises: “Solve structural issues before raising more capital”

Geographic Considerations

In developing ecosystems like Norway:

- Local investors may set unfavorable norms

- International VCs can offer better terms but risk draining local capital

- Founder education becomes critical

Key Takeaways for Founders

- Protect Founder Equity: Maintain >50% ownership through seed stage

- Understand VC Economics: Align with investors who play the long game

- Seek Experienced Advice: Avoid learning costly lessons through experience

- Be Transparent: Like our Norwegian CEO, surface issues early with potential investors

For more insights on startup financing, connect with the author via email or Signal.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Better Homes & Gardens Copper Chiminea Fire Pit – Heat Resistant

Image: Premium product showcase

Image: Premium product showcase

Professional-grade better homes & gardens copper chiminea fire pit – heat resistant combining innovation, quality, and user-friendly design.

Key Features:

- Cutting-edge technology integration

- Streamlined workflow optimization

- Heavy-duty construction for reliability

- Expert technical support available

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!