Smartphone Penetration Reaches 55% in Europe’s Top 5 Markets

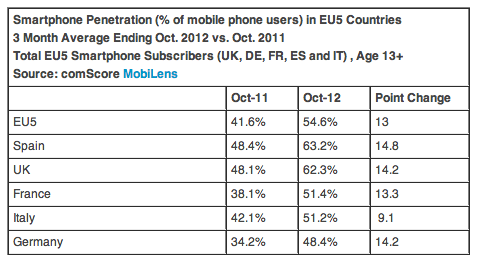

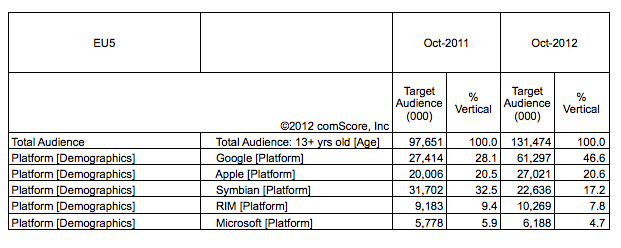

Europe’s mobile landscape has reached a pivotal milestone, with smartphones now in the hands of a majority of consumers across its five largest markets. According to comScore’s latest MobiLens research, France, Germany, Italy, Spain, and the UK collectively report 55% smartphone penetration – representing 131.5 million users as of October 2012.

Key Market Trends

- Spain leads with 63.2% smartphone adoption (+15% year-over-year)

- UK follows closely at 62.3% smartphone usage

- Germany trails at 48.4%, the only market below 50%

The Shifting Competitive Landscape

UK Market Dynamics

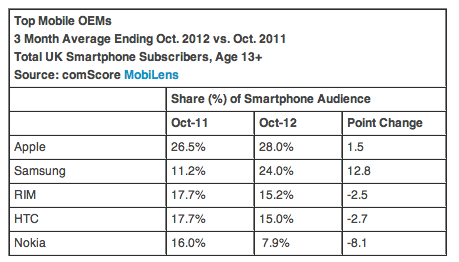

While Apple maintains a narrow lead in the UK (28% market share), Samsung is rapidly closing the gap with a 12.8 percentage point surge to 24% share. Other manufacturers face declining fortunes:

- Nokia dips below 10% for the first time

- RIM and HTC continue to lose ground

Platform Wars

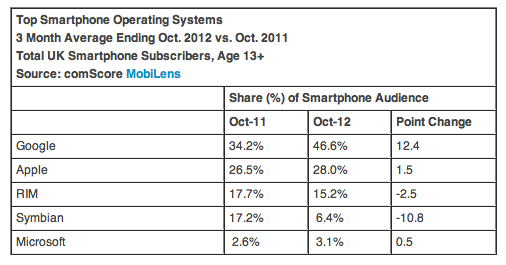

Android dominates the UK with 46.6% market share, largely driven by Samsung’s success. The platform landscape shows:

- Android: 46.6% (+12.4% YoY)

- iOS: 28% (+1.5% YoY)

- RIM/Symbian: Continued decline

- Windows Phone: Modest growth to 3.1%

Pan-European Perspective

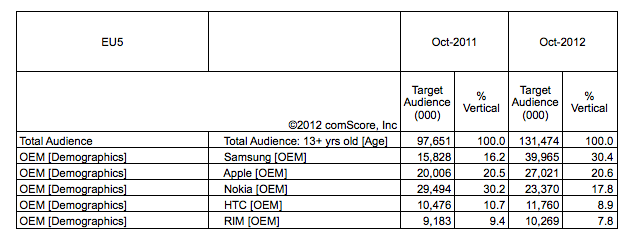

Across all five major European markets, Samsung has overtaken Apple with over 30% market share compared to Apple’s 20%. This represents a significant shift from the previous year when Apple led the market.

Platform Dominance

Android’s European stronghold is undeniable, commanding over 46% of all smartphones in use. The platform distribution reveals:

- Android’s rise correlates with Samsung’s growth

- Apple maintains stable but stagnant share

- Nokia’s decline most pronounced among OEMs

Market Outlook

The data suggests several emerging trends:

- Samsung’s momentum positions it to potentially overtake Apple in the UK

- Android’s ecosystem advantage continues to drive adoption

- Holiday sales may temporarily boost Apple’s numbers

- Nokia’s transition to Windows Phone shows early but modest signs

As smartphone penetration crosses the majority threshold in Europe’s largest markets, the competitive dynamics between manufacturers and platforms will only intensify in the coming quarters.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Men’s Parotic Crew Short Sleeve Tee

Image: Premium product showcase

Image: Premium product showcase

High-quality men’s parotic crew short sleeve tee offering outstanding features and dependable results for various applications.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!