Bloomberg Unveils Bloomberg Beta

Following years in media, tech entrepreneur Roy Bahat is set to lead a new venture fund focused on early-stage startups. Launched by the financial news and data powerhouse, Bloomberg Launches Bloomberg Beta represents a fresh approach from traditional investment strategies.

What Is Bloomberg Beta?

This $75 million dedicated venture capital fund marks a significant expansion for Bloomberg’s commitment to supporting tech innovation at its earliest stages. Unlike their previous internal initiative (which was shut down as co-founder Matt Turck departed to join FirstMark Capital), Bloomberg Beta operates independently and aims to generate returns typical of dedicated venture funds.

Strategic Distinction from Previous Ventures

Bloomberg Beta distinguishes itself by being a standalone entity that invests without strategic motives, offering pure venture capital backing. This financial independence separates it from internal programs like Bloomberg Ventures (2008), which was dissolved after its co-founder Matt Turck’s departure.

Roy Bahat at the Helm

Roy Bahat brings considerable experience leading Bloomberg Beta with his background in tech startups:

- Former head of IGN Entertainment

- Chairman of OUYA, a prominent gaming startup later acquired by Amazon

- Previously served on boards for Revision3 and Flixster His approach is characterized by flexibility: “We’re happy to go as early as the womb,” he states.

Operational Structure & Team

The fund will operate with three partners initially. Key team members include:

- Roy Bahat (San Francisco) - Leading from Bloomberg’s West Coast offices

- Karin Klein (New York City) - Previously head of new initiatives at Bloomberg and VP at Softbank Investment, joining to manage East Coast operations.

- James Cham - Most recently principal at Trinity Ventures with expertise in consumer services, enterprise software, and digital media. Prior experience includes being a VP at Bessemer Venture Partners.

Investment Focus Areas

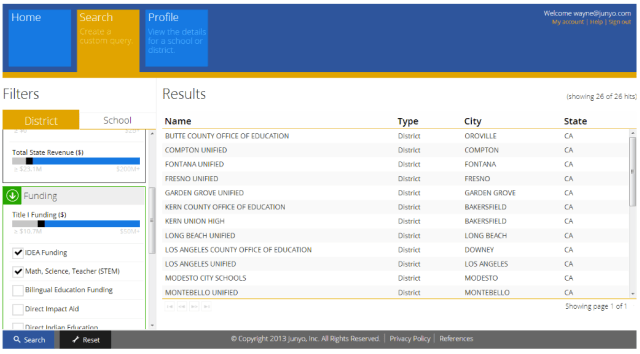

Bloomberg Beta targets companies building innovative technologies across:

- Big-data technology platforms

- Content discovery solutions

- New media distribution models

- Human-computer interaction advancements They are also exploring the “company builder” model, aiming to both create and invest in promising startups.

Notable Investments Already Announced

The fund has already completed investments in nine companies including:

- Newsle (now owned by Salesforce)

- MkII (acquired)

- Nodejitsu (acquired)

- Codecademy (acquired)

- Errplane (acquired)

- ProsperWorks A few additional portfolio companies are expected to be announced soon.

Broader Context

The formation of Bloomberg Beta aligns with broader industry trends where media conglomerates increasingly establish independent venture funds. However, its explicit goal is financial returns through traditional venture capital principles rather than strategic integration.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Nite Ize Financial Tool RFID Blocking Wallet

Image: Premium product showcase

Image: Premium product showcase

Advanced nite ize financial tool rfid blocking wallet engineered for excellence with proven reliability and outstanding results.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!