Credit Karma Now Offers Free Weekly Credit Reports – No Strings Attached

In a major win for consumers, Credit Karma has rolled out free weekly credit reports with no hidden fees or trial periods. This move sets the platform apart from misleading services that often lure users with “free” reports only to charge them later.

Why Credit Karma Stands Out

Unlike predatory credit monitoring services, Credit Karma delivers:

- Truly free credit scores and reports (no asterisks)

- Weekly updates via partnerships with TransUnion and VantageScore

- Actionable insights with clear explanations of credit factors

How It Benefits Users

Credit Karma doesn’t just show your credit data – it helps you understand and improve it. Key features include:

1. Comprehensive Credit Monitoring

- Alerts for balance changes, new accounts, and credit inquiries

- “Credit Report Card” grading system for different financial behaviors

- Explanations of how each factor impacts your overall score

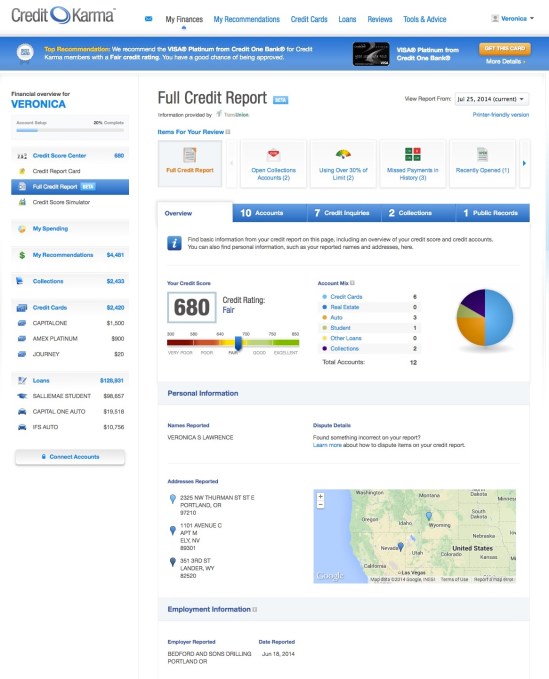

2. Full Credit Report Access

Previously limited to summaries, users can now:

- View complete TransUnion credit reports anytime

- Refresh reports weekly (versus annual free reports from AnnualCreditReport.com)

- All accessed through soft inquiries that don’t affect credit scores

3. Personalized Financial Guidance

The platform provides:

- Customized recommendations based on your credit profile

- Educational resources to demystify credit scoring

- Referrals to relevant financial products (Credit Karma’s revenue model)

The Credit Landscape Today

Credit Karma highlights concerning statistics:

- 25% of credit reports contain errors affecting scores

- 33% of consumers have never checked their reports

- The average credit score is 633 (“good” credit starts at 720)

Example of Credit Karma’s new full credit report interface

Example of Credit Karma’s new full credit report interface

Competitive Advantage

This enhancement helps Credit Karma compete with:

- Traditional credit bureaus

- Services like ReadyForZero (financial advisory)

- Credit Sesame (which charges $9 for full reports)

For consumers focused on financial health, this development represents unprecedented access to credit information without cost or commitment.