The Insurtech Boom: A Tale of Two Valuations

Insurance technology (insurtech) startups are riding an unprecedented wave of growth in 2024. From massive funding rounds to high-profile IPOs, the sector continues to redefine modern insurance solutions.

Lemonade’s Blockbuster IPO

Lemonade’s July 2024 public debut became the defining moment for insurtech valuations:

- Priced at $29/share (above raised range)

- Initial valuation: $1.6 billion

- First-day pop: 139% (closing at $69.41)

- Current valuation: ~$4.31 billion (Google Finance)

This explosive public market reception contrasted sharply with Lemonade’s final private valuation of $2 billion, signaling a dramatic repricing by retail investors.

Hippo’s $150M Series E: A Different Valuation Approach

This week, compe***** Hippo announced:

- $150 million Series E funding

- $1.5 billion post-money valuation

- $270M gross written premium (140% YoY growth)

The Valuation Discrepancy

Comparing key metrics reveals striking differences:

| Metric | Lemonade | Hippo |

|---|---|---|

| Valuation | $4.31B | $1.5B |

| Annualized Premium | $152M | $270M |

| Valuation/Premium | 28.4x | 5.6x |

Note: Lemonade’s premium annualized from Q1 2024; Hippo’s reflects trailing 12 months

Market Dynamics: Public vs. Private Valuations

Hippo CEO Assaf Wand attributes the gap to:

- Public Market Irrationality: Over-enthusiasm for consumer brands

- Brand Premium: Lemonade’s strong consumer recognition

- COVID-19 Fundraising: Private investors taking more conservative approaches

The Funding Context

- Raised entirely through virtual meetings

- New investors: FinTLV, Ribbit Capital, Dragoneer, Innovius Capital

- Existing investors participated significantly

Fundamental Differences

Key factors influencing valuation multiples:

- Business Models:

- Lemonade: Focused on renters insurance (lower premiums)

- Hippo: Homeowners insurance (higher premiums)

- Margins:

- Lemonade’s Q1 gross margin: 18%

- Traditional SaaS multiples don’t apply

Expert Perspective

Wand compares the situation to Tesla’s valuation premium over legacy automakers, suggesting:

- Public markets reward brand strength disproportionately

- Private markets remain more fundamentals-driven

- The gap represents shifting investor priorities

What’s Next for Insurtech?

As both companies move forward:

- Lemonade’s upcoming earnings will test its valuation

- Hippo’s growth trajectory remains strong

- The sector continues attracting significant investment

This valuation divergence highlights how public and private markets assess growth potential differently—a trend that may reshape future funding strategies across tech sectors.

🚀 Technology Solutions & Recommendations

Enhance your tech capabilities with these cutting-edge products that complement the technological innovations discussed in this article:

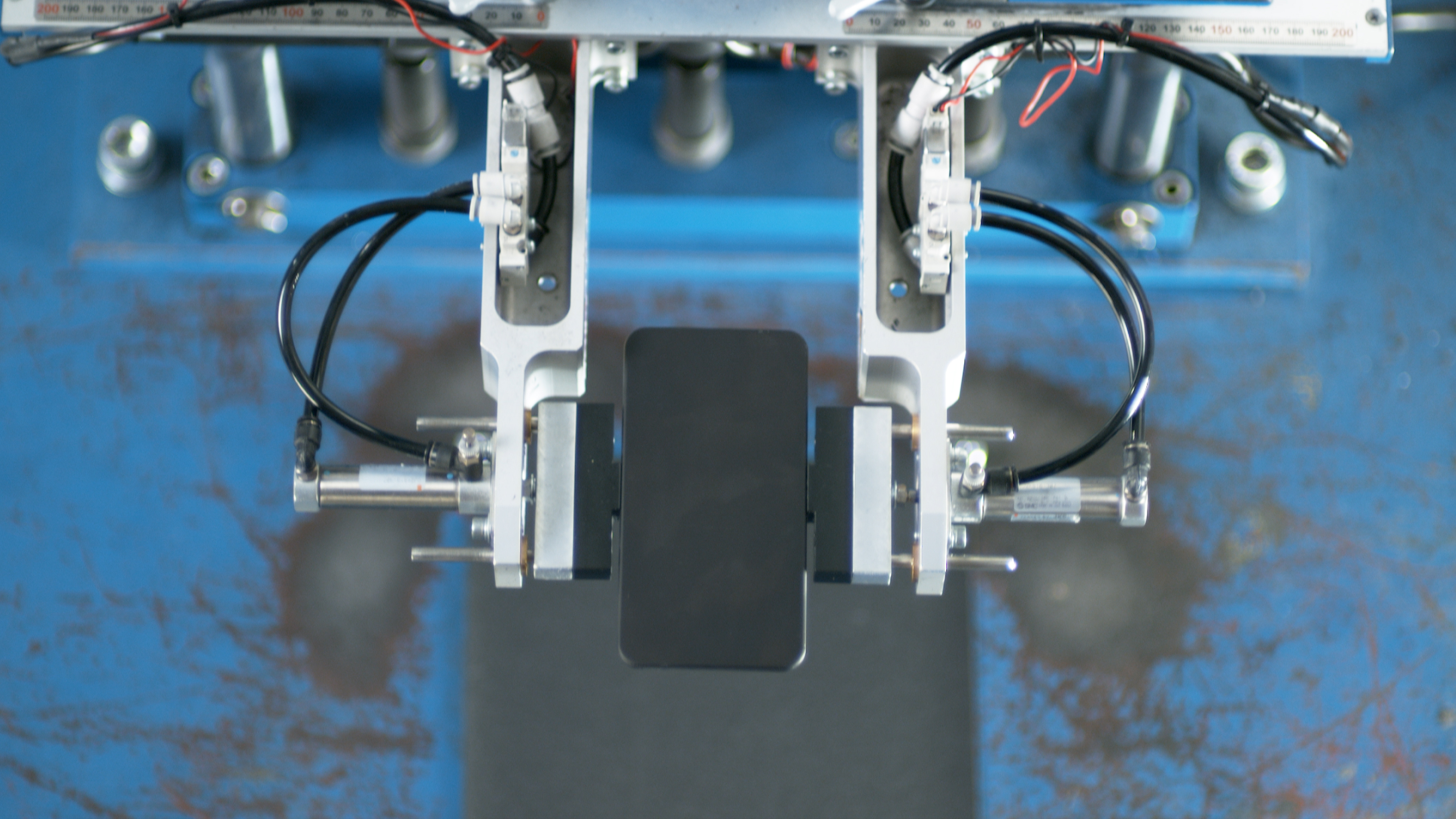

🛍️ Featured Product 1: HKT – Button

Image: Premium product showcase

Image: Premium product showcase

As the article highlights the rise of insurtech solutions like Lemonade, the HKT – Button represents the physical counterpart to these digital insurance innovations. It appeals to readers interested in modern home protection by offering a simple, reliable tool that aligns with the tech-forward approach of today’s insurance startups.

The HKT – Button is a sleek, one-touch emergency alert device designed for homeowners and renters, offering instant connection to emergency services or your insurance provider. In an era where insurtech startups like Lemonade are revolutionizing how we protect our homes, the HKT – Button provides a tangible layer of security that complements modern insurance solutions. Whether you’re tech-savvy or simply value peace of mind, this minimalist device bridges the gap between smart insurance products and real-world safety.

Key Features:

- One-touch emergency alert for instant assistance

- Compact, waterproof design for placement anywhere in the home

- Compatible with most smart home systems

- Optional integration with select insurtech apps for streamlined claims

🔗 View Product Details & Purchase

🛍️ Featured Product 2: HKG – Luggage

Image: Premium product showcase

Image: Premium product showcase

Readers interested in innovative protection solutions (like insurtech) will appreciate HKG Luggage’s focus on safeguarding valuables through quality design—paralleling the article’s theme of modern risk management.

HKG Luggage offers durable, travel-ready protection for your belongings—much like how modern insurtech companies safeguard your assets. With sleek designs and robust materials, our luggage ensures your valuables arrive safely, whether you’re jet-setting or commuting. While we don’t insure your items, we provide the first line of defense against travel wear and tear.

Key Features:

- Lightweight yet impact-resistant polycarbonate shell

- 360-degree spinner wheels for smooth mobility

- TSA-approved combination locks for security

- Expandable compartments for flexible packing

🔗 View Product Details & Purchase

💡 Need Tech Consultation? Our technology experts are ready to help you implement the perfect solution for your digital transformation needs!