By Si Shen, Co-founder & CEO of PapayaMobile (Beijing-based mobile company operating AppFlood) and former Google mobile team member

China’s Tech Surge: A Catalyst for US Economic Growth

The past year has marked a transformative period for Chinese technology firms. Alibaba’s highly anticipated NYSE IPO—projected to raise \(20 billion at a \)200 billion valuation—has captured global attention. Yet just a few years ago, names like Alibaba and Tencent were virtually unknown in Western markets.

As China’s tech giants emerge on the world stage, many American observers wonder: Is this development a competitive threat or an economic opportunity? The evidence strongly suggests the latter.

How Chinese IPOs Boost the US Economy

Chinese companies have become major players in US financial markets:

- Record-breaking participation: Chinese firms accounted for 63% of total IPO funds raised in the US (Bloomberg)

- Strong returns: Chinese IPOs delivered 44% average returns in the 12 months preceding June 2014

- Investor appeal: “China became the logical destination for investors seeking returns when US tech underperformed,” notes Kurt Ayling of Susquehanna Financial Group

These high-profile listings inject capital into US markets while providing American investors access to China’s growth story.

Chinese Investment Fuels US Tech Innovation

Beyond IPOs, Chinese companies are actively investing in American technology:

- $6 billion invested in US tech firms during 2014 (Rhodium Group)

- Strategic acquisitions: Tencent’s 15 US deals (including Snapchat and Whisper) and Alibaba’s 7 investments (including Tango)

- Job creation: Chinese acquisitions typically increase local staffing to access US talent pools

Notable transactions include Lenovo’s purchases of IBM’s x86 server division and Motorola Mobility—demonstrating how Chinese capital can revitalize established US tech assets.

Chinese Tech Expansion Creates Mobile Opportunities

Chinese companies are pursuing multiple strategies for US market penetration:

1. Direct Market Entry

- Alibaba’s 11Main.com challenges Amazon/eBay with unique merchandise

- Mobile leaders like Cheetah Mobile and Baidu rank among top global app publishers

2. Advertising Growth

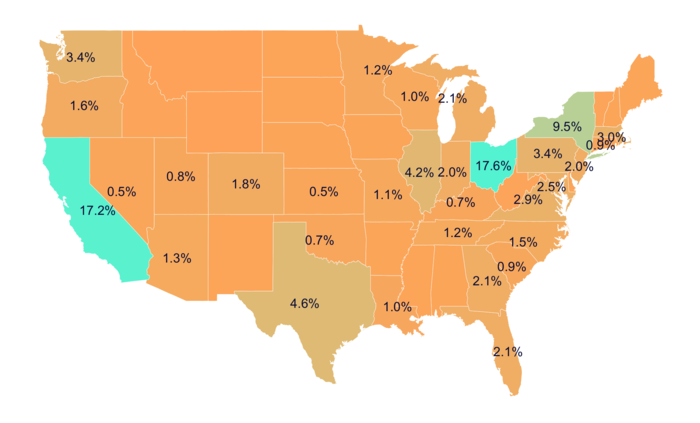

- Chinese mobile ad spending on US user acquisition grew 401% (Q1-Q2 2014)

- US developers benefit from Chinese advertiser demand, creating new revenue streams

3. Market Access Reciprocity

- China’s 700 million mobile users represent massive potential for US app developers

- Successful US games like Temple Run 2 and Fruit Ninja already rank among China’s top mobile titles

The Path Forward: Collaboration Over Competition

As Chinese tech firms globalize, they create numerous advantages for the US economy:

- Capital infusion through IPOs and investments

- Job creation via acquisitions and expansion

- New revenue opportunities for developers and advertisers

- Reciprocal market access to China’s massive consumer base

For American businesses and investors, engagement with China’s tech sector represents one of today’s most promising growth opportunities. By embracing this evolution rather than resisting it, US market participants stand to gain substantially from China’s technological rise.