Felicis Ventures Secures $96M Fund, Vows Unwavering Support for Founders

The Evolution of Early-Stage Investing

A decade ago, the venture capital landscape looked markedly different. The rise of “super-angels”—individual investors backed by modest funds—challenged traditional VC firms. Pioneers like Aydin Senkut, Jeff Clavier, and Dave McClure sparked debates about their role versus established players.

Today, the boundaries have blurred significantly. New compe*****s have emerged, including:

- AngelList syndicates

- Crowdfunding platforms

- Emerging early-stage funds like Homebrew and Binary Capital

Felicis Ventures Doubles Down on Founder Commitment

Aydin Senkut, former Google product manager and founder of Felicis Ventures, is making waves with a new $96 million fund. The firm has formalized a groundbreaking policy: always voting shares in alignment with founders’ wishes.

“We’re making a deeper commitment to our founders,” Senkut explained. “This formal pledge to support their decisions sets us apart in the investment community.”

Why This Matters for Startups

Jack Abraham, founder of Milo (acquired by eBay) and Felicis advisor, emphasizes the competitive advantage:

“Top entrepreneurs have options. Differentiation through genuine founder alignment is powerful—especially in early stages. Felicis has consistently prioritized this approach.”

Strategic Focus Areas for the New Fund

Felicis will continue its dual investment strategy:

- Core Market Reinvention: Transformative plays in established sectors

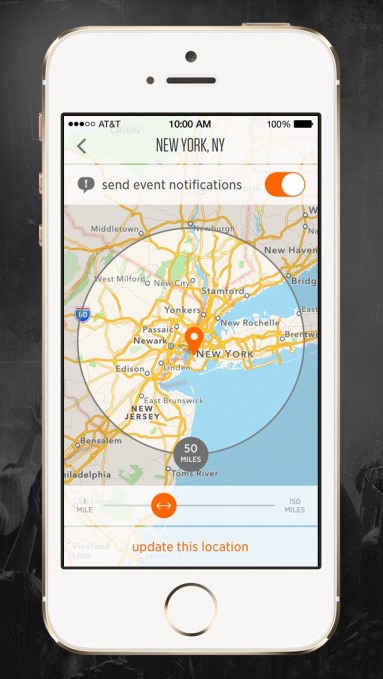

- Frontier Technologies: Cutting-edge innovations in fields like:

- Personalized medicine

- Machine learning/AI

- Security solutions

- Mobile infrastructure

Portfolio Highlights

The firm boasts an impressive track record:

- 120+ technology investments

- 50 exits/IPOs

- $5.6B+ aggregate enterprise exit value

Notable successes include:

- Counsyl ($1B+ valuation)

- Bonobos

- Rovio (Angry Birds creator)

- Fitbit

Fund Structure and Team Growth

The latest fund features:

- Exclusive institutional backing

- Three university endowments as limited partners

Felicis has expanded to:

- 6 full-time team members

- 2 part-time employees

- 2 advisors

This growth enables Felicis to take more leadership roles in funding rounds, moving beyond passive participation.

The Future of Founder-Friendly Investing

As Abraham notes, many legendary VC firms began with modest funds before scaling success. Felicis appears poised to follow this trajectory while maintaining its distinctive founder-first philosophy—a compelling proposition in today’s competitive investment landscape.