Japanese Fintech Exchange Corp. Secures $3.3M for Cardless Payment Solution Paidy

Revolutionizing E-Commerce Payments in Japan

Tokyo-based fintech startup Exchange Corp. has launched Paidy, an innovative cardless payment service for online retailers, backed by a $3.3 million Series A funding round. The solution aims to transform digital commerce by eliminating credit card dependency in Japan’s growing e-commerce market.

From P2P Lending to Payment Innovation

Founded by former Goldman Sachs trader Russell Cummer, Exchange Corp. initially operated as a peer-to-peer lending platform, facilitating over $15 million in loans. The company pivoted to payment services after identifying market gaps in Japan’s digital payment landscape.

“Paidy represents the natural evolution of our credit assessment capabilities,” explains Cummer. “Having already established systems to evaluate borrower credibility, we’re now applying this expertise to revolutionize online checkout experiences.”

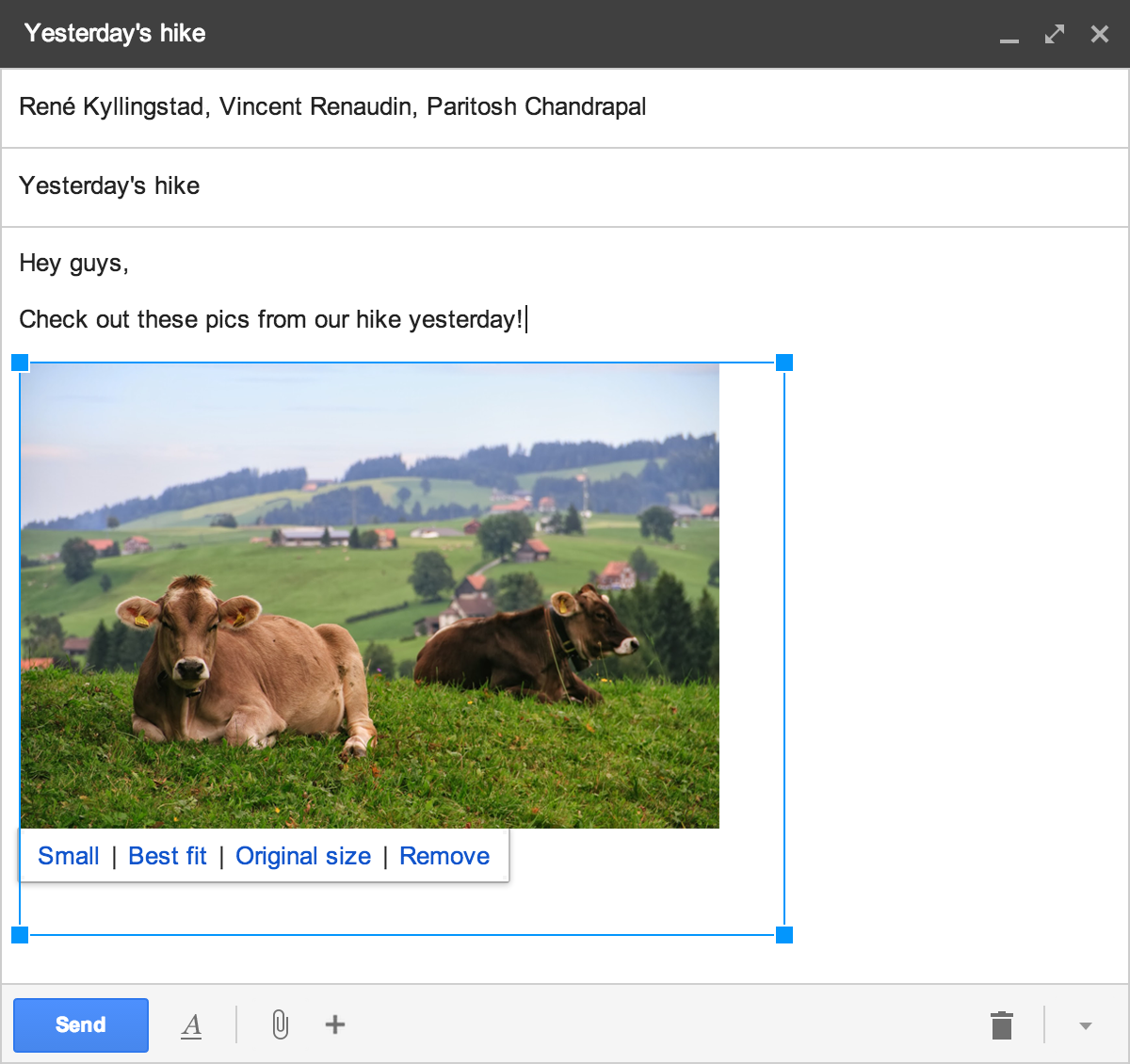

How Paidy Works: Simplicity Meets Security

The cardless payment solution offers:

- Frictionless checkout requiring only name and email

- Risk-free transactions for merchants with guaranteed payment within 18 days

- Flexible payment options including lump-sum or installment plans

“In Japan, 40% of online transactions still avoid credit cards,” notes Cummer. “Consumers prefer convenience store payments or bank transfers due to security concerns. Paidy bridges this gap.”

Investor Confidence in Financial Innovation

The funding round attracted prominent investors including:

- Arbor Ventures (lead investor)

- CyberAgent Ventures

- Recruit Strategic Partners

Melissa Guzy of Arbor Ventures commented: “Asia’s e-commerce boom, particularly mobile commerce, creates tremendous potential for cardless payment solutions like Paidy.”

The Future of Payments in Asia

Exchange Corp.’s innovation aligns with broader fintech trends:

- Modernizing legacy payment infrastructure

- Leveraging alternative data for credit decisions

- Enhancing conversion rates for online merchants

“Credit card technology is fundamentally outdated,” Cummer asserts. “Data-driven financial services represent the future of transactions in Asia and beyond.”

With its unique approach to digital payments, Paidy positions Exchange Corp. at the forefront of Japan’s fintech revolution, addressing both consumer preferences and merchant needs in the rapidly growing Asian e-commerce market.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Boston Red Sox Balaclava Hoodie

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted boston red sox balaclava hoodie delivering superior performance and lasting value.

Key Features:

- Cutting-edge technology integration

- Streamlined workflow optimization

- Heavy-duty construction for reliability

- Expert technical support available

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!