RBI Tightens Consumer Loan Regulations: Startups Brace for Impact

India’s central bank has introduced stringent measures to curb the rapid growth of consumer credit, a move expected to ripple through consumer spending and disrupt startups across the nation’s thriving fintech ecosystem.

Key Regulatory Changes

The Reserve Bank of India (RBI) has implemented several critical adjustments:

- 25% increase in risk weights for unsecured personal loans, credit cards, and consumer durable loans (now 125%)

- Higher risk weights for credit card receivables:

- Banks: Increased from 125% to 150%

- NBFCs: Increased from 100% to 125%

- Exemptions remain for mortgages, vehicle loans, education loans, and gold-backed debt

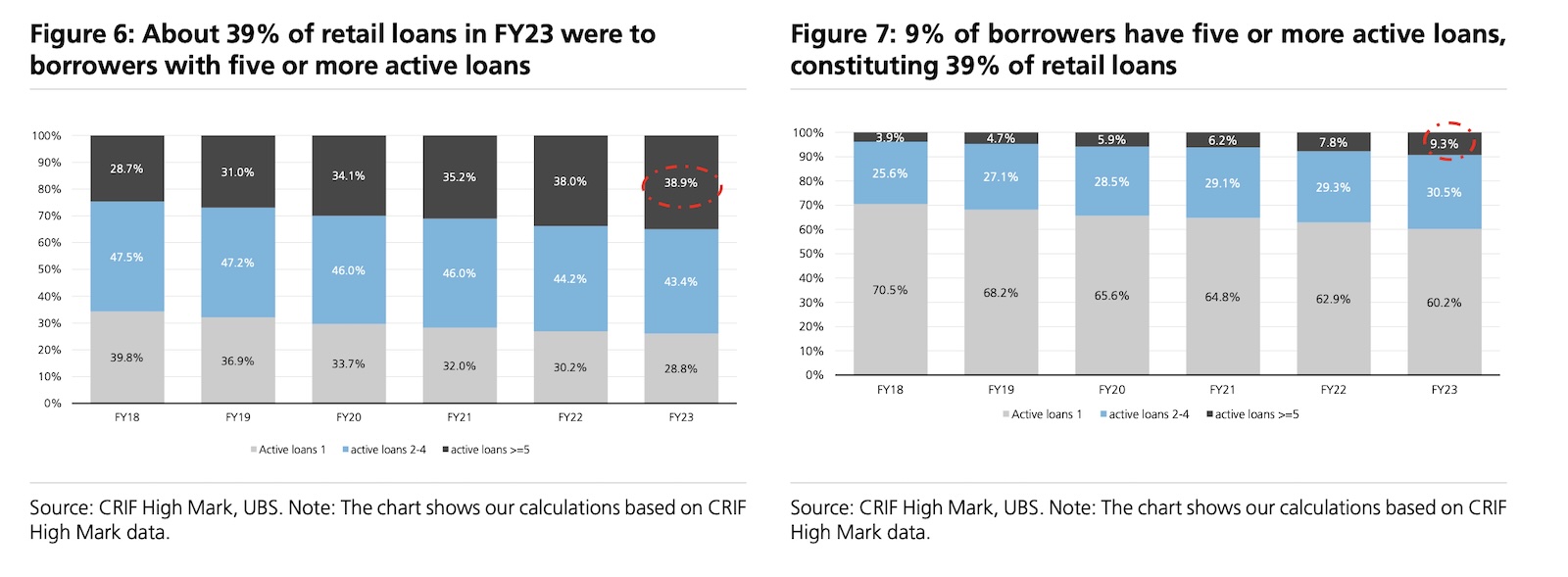

Source: UBS via S&P Global Market Intelligence

Source: UBS via S&P Global Market Intelligence

Why the Sudden Shift?

The RBI’s decision comes as unsecured loan growth surges at nearly double the rate of overall credit expansion. Goldman Sachs analysts note this reflects growing regulatory concern about:

- Excessive growth in unsecured lending

- Increasing NBFC reliance on bank funding

- Potential systemic risks in consumer credit markets

Startup Sector Consequences

Fintech startups and digital lenders face significant challenges:

- Increased capital costs: NBFC borrowing expenses will rise

- Growth constraints: Lending partners may tighten credit standards

- Profitability pressures: BNPL and personal loan products face margin compression

“Higher funding costs and capital requirements will directly impact product profitability in BNPL and personal loans,” Jefferies analysts noted in a recent report.

Industry-Wide Ripple Effects

The measures will particularly affect:

- Major lenders with high unsecured loan exposure (Bajaj Finance, IDFC First, SBI)

- NBFCs dependent on bank funding (now >50% of borrowings)

- Alternative funding sources may see increased competition

Goldman Sachs warns: “These changes will likely reduce structural ROEs in consumer lending, especially for NBFCs facing higher funding costs and tighter competition.”

The Road Ahead

As the financial sector adapts to these changes, startups must:

- Reassess lending partnerships

- Optimize capital efficiency

- Explore alternative funding strategies

The RBI’s actions signal a new era of cautious growth in India’s consumer credit market, with significant implications for innovation and accessibility in digital finance.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Infinity Tools Waxed Cotton Canvas Shop Aprons

Image: Premium product showcase

Image: Premium product showcase

Advanced infinity tools waxed cotton canvas shop aprons engineered for excellence with proven reliability and outstanding results.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!