Slack’s Valuation Surge: Is It Justified Amid Salesforce Acquisition Rumors?

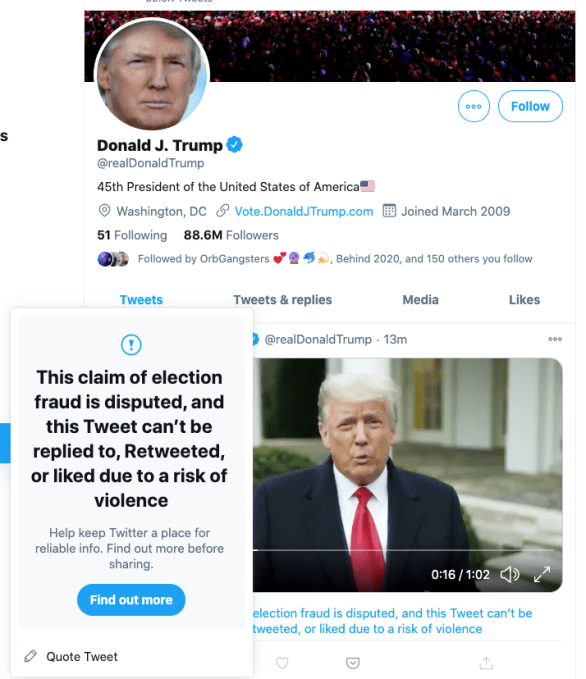

The Market Reacts to Salesforce’s Potential Slack Acquisition

Recent reports of Salesforce considering a Slack acquisition have sent shockwaves through the tech investment community. This potential merger presents both exciting synergies and valid concerns about how Slack would integrate with Salesforce’s existing ecosystem.

Potential Benefits:

- Enhanced mindshare: Slack’s startup appeal could complement Salesforce’s enterprise dominance

- Expanded reach: Salesforce’s vast customer base could accelerate Slack’s adoption

- Competitive edge: Combined forces could better challenge Microsoft Teams

Key Questions:

- How would Slack fit into Salesforce’s CRM-focused strategy?

- What would happen to Salesforce’s existing Chatter platform (launched in 2009)?

- Can the combined entity effectively compete against Microsoft’s collaboration suite?

Analyzing Slack’s Shifting Valuation

The market has spoken clearly about this potential deal:

- Pre-news valuation: ~\(16.88 billion market cap (\)30/share)

- Post-news valuation: ~\(22.58 billion market cap (\)40/share)

- Investor reaction: Slack shares surged while Salesforce dipped ~$20/share

Revenue Metrics (via YCharts):

- Trailing twelve months: $768.14 million

- Last quarter annualized: $863.44 million

- Current fiscal year estimate: $877.25 million

Valuation Multiples: Before and After

Pre-acquisition talk multiples:

- 22x trailing twelve months revenue

- 19.5x last quarter annualized

- 19.2x current fiscal year estimate

Post-acquisition talk multiples:

- 29.4x trailing twelve months revenue

- 26.2x last quarter annualized

- 25.7x current fiscal year estimate

Industry Context: Is Slack Overvalued?

Comparing Slack to peers in the Bessemer Cloud Index reveals:

- Twilio: Similar multiples with lower gross margins

- Avalara: Comparable multiples but slower growth

- Market norms: Slack’s valuation appears reasonable relative to cloud software peers

Key Considerations:

- Microsoft’s competitive pressure on Slack

- Potential for improved competitive positioning with Salesforce’s backing

- Current market appetite for high-growth SaaS companies

The Bottom Line

While Slack’s valuation has certainly jumped on acquisition speculation, the numbers suggest this isn’t an irrational market reaction. Given comparable valuations in the cloud software space and the strategic potential of a Salesforce partnership, Slack’s current price appears justified within today’s market context.

The bigger questions remain:

- Will Salesforce follow through with an acquisition?

- Can the combined companies create meaningful integration?

- How will Microsoft respond to this potential challenger?

Only time will tell if this valuation surge reflects true strategic potential or simply acquisition speculation. For now, the market seems to be betting on the former.