How SOLO Is Transforming Credit Scoring with User-Permissioned Data

Traditional credit bureaus rely on fragmented third-party data, often missing critical insights into a borrower’s true financial behavior. Georgina Merhom, founder of SOLO, argues this outdated approach punishes consumers for minor missteps while overlooking valuable financial signals.

The Problem with Traditional Credit Bureaus

“Credit bureaus remain relevant, but their narrow focus on late payments creates a punitive system,” Merhom told TechCrunch. “By only tracking monetary transactions, lenders miss a wealth of behavioral data that could paint a more accurate picture.”

SOLO’s Innovative Approach

SOLO addresses these limitations through:

- First-party data integration: Aggregates user-permissioned data from multiple verified sources

- Comprehensive financial profiling: Analyzes bank transactions (via Plaid/Teller), e-commerce activity (Shopify/Amazon), and business systems (QuickBooks)

- Real-time behavioral insights: Tracks digital footprints to assess financial responsibility beyond credit scores

From Cybersecurity to Financial Innovation

Merhom’s background as a cybersecurity data scientist proved foundational. Her work analyzing dark web activity taught her that:

- Contextual data provides deeper insights than isolated data points

- Diverse data sources create more accurate behavioral profiles

She applied these principles at Zivmi, her cross-border payments app in Egypt, where she developed alternative credit assessment methods for unbanked freelancers using platforms like GitHub and Upwork.

The Growing Alternative Credit Market

SOLO enters a competitive space with several innovative approaches:

- Altro: Builds credit via recurring subscription payments

- Kredivo: Combines neobanking with credit building

- Masa Finance: Developing decentralized credit protocols

SOLO’s Ambitious Roadmap

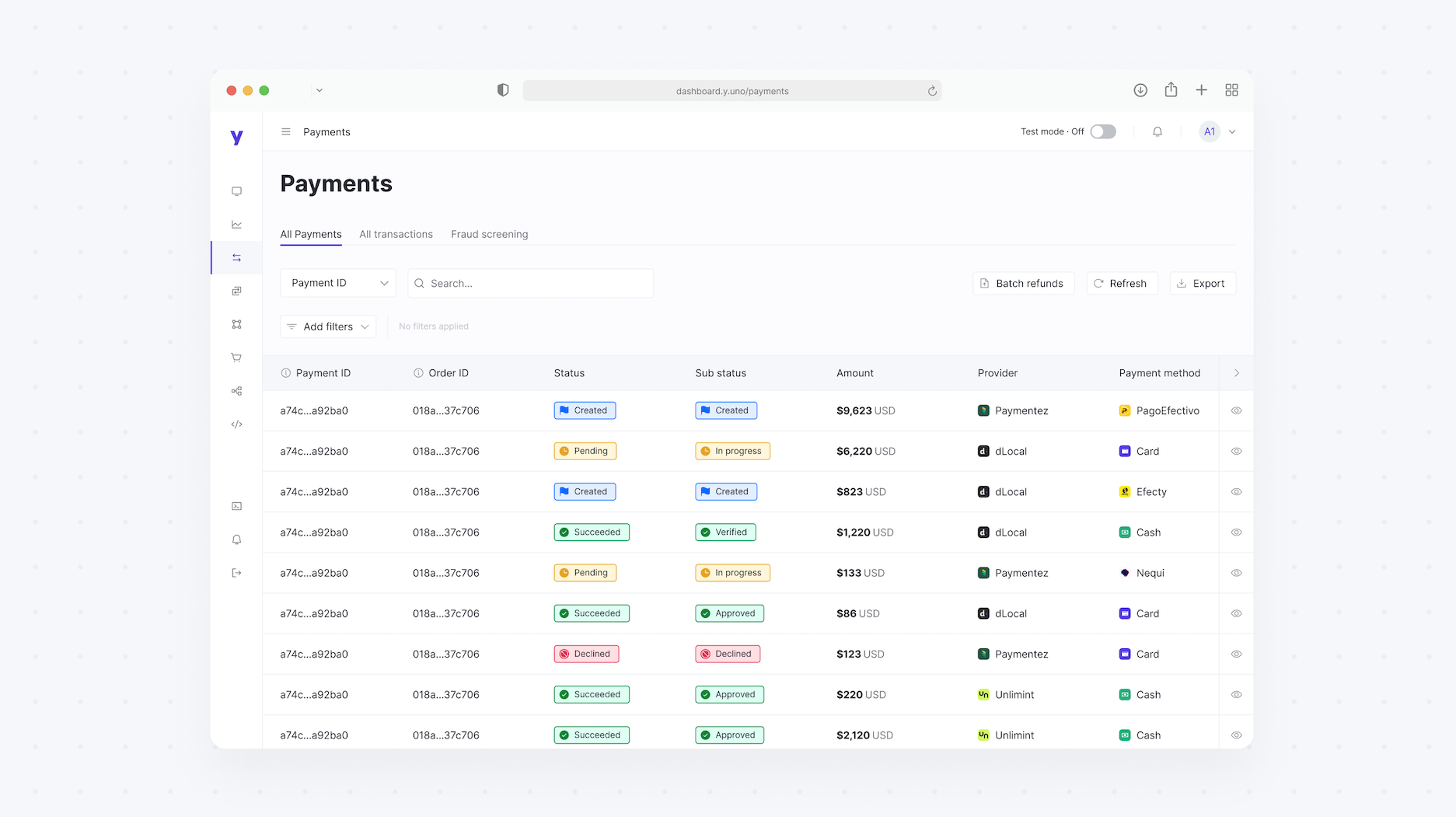

After two years in development, SOLO recently showcased its platform to hundreds of financial institutions. Key objectives include:

- Securing 100 U.S. bank pilots in 2024

- Reducing loan processing time from months to minutes

- Cutting operational costs by up to 70%

- Increasing customer lifetime value

“Banks spend $29 billion annually on application processing alone,” Merhom noted. “Our solution eliminates manual verification while helping lenders identify untapped opportunities in their portfolios.”

With several pilot agreements already underway, SOLO aims to redefine credit assessment by focusing on comprehensive financial behavior rather than isolated credit events.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: A&I Genuine Part 168492A BRAKE INSULATOR

Image: Premium product showcase

Image: Premium product showcase

High-quality a&i genuine part 168492a brake insulator offering outstanding features and dependable results for various applications.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!