The Reality of the Series A Funding Crunch

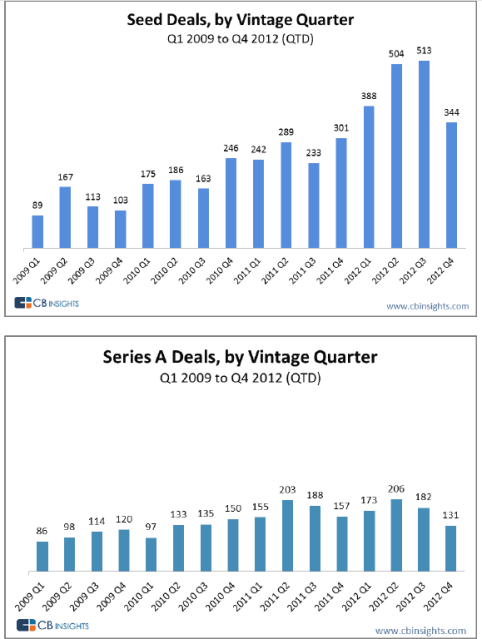

While industry chatter about a “Series A crunch” has been ongoing, concrete data has been scarce—until now. Venture capital analytics firm CB Insights recently released a seed financing report that sheds light on the challenges startups face when transitioning from seed to Series A funding.

Key Findings: Supply, Demand, and the Funding Gap

Contrary to popular belief, Series A funding levels have remained stable. The perceived crunch stems from an explosion in seed-stage investments, flooding the market with startups vying for limited Series A capital.

- Supply vs. Demand: While Series A funding hasn’t declined, the pool of seed-funded startups has grown exponentially, creating intense competition.

- Projected Orphaned Startups: CB Insights estimates 1,000 to 4,000 seed-funded companies—collectively raising over $1 billion—will fail to secure Series A financing, leaving them “orphaned.”

Why Startups Are Being Left Behind

Historical data reveals that 40% of seed-funded startups never secure Series A funding. With seed investments surging in recent years, this percentage translates to a significantly larger number of startups facing funding gaps in the near future.

Survival Strategies for Orphaned Startups

Being orphaned doesn’t spell the end. CB Insights highlights two potential paths:

- Bootstrapping: Startups generating sufficient revenue can sustain operations independently.

- Acquisition: Some may attract buyout interest from larger firms seeking innovation.

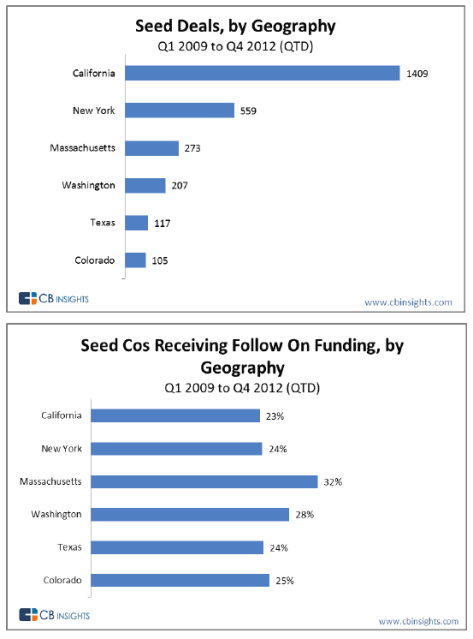

Geographic Trends in Funding Success

Location plays a surprising role in Series A success rates:

- California: Leads in total seed deals but doesn’t guarantee Series A success.

- Massachusetts: Startups here are most likely to secure follow-on funding, outperforming other regions.

The Bottom Line

The Series A crunch isn’t about shrinking capital—it’s about overwhelming demand. For founders, the takeaway is clear: differentiation and sustainable revenue models are critical to avoid becoming part of the orphaned statistic.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: 501 ’93 Shorts – Good Liar

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted 501 ’93 shorts – good liar delivering superior performance and lasting value.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!