Chase Bank Acquires Bloomspot to Expand Digital Offers Platform

In a strategic move to strengthen its digital offers capabilities, JPMorgan Chase & Co. has acquired Bloomspot, a San Francisco-based local offers startup. The acquisition, announced in December 2012, brings Bloomspot’s technology and team under Chase’s umbrella to enhance its customer rewards programs.

Key Details of the Acquisition

- Team Integration: Nearly all of Bloomspot’s 100-person team will join Chase’s San Francisco office, located just blocks away from Bloomspot’s headquarters.

- Undisclosed Terms: The financial details remain confidential, but the deal includes both technology assets and personnel.

- Strategic Fit: Chase plans to leverage Bloomspot’s expertise to scale its offers programs across digital channels.

How Bloomspot Differed from Traditional Deal Platforms

Unlike daily deal giants like Groupon, Bloomspot focused on precision-targeted offers:

- Utilized credit card data to match merchants with their best customers

- Verified offer redemptions and tracked customer spending

- Achieved a 72% merchant repeat customer rate with an average $140 upsell per offer

Chase’s Vision for Digital Offers

Jeff Kinder, President of Chase Offers, shared insights on the acquisition:

“Consumers expect relevant offers from their bank. Bloomspot’s team brings invaluable experience in operating at scale, which is crucial for Chase’s massive customer base.”

Future Offer Channels May Include:

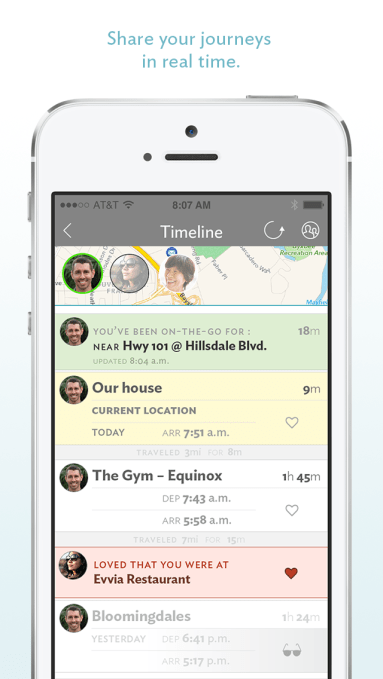

- Mobile apps

- Online banking portals

- ATM interfaces

- Statement inserts

Bloomspot’s Market Position at Time of Acquisition

- 2 million members and 500,000 merchant partners

- Operated in major U.S. markets including NYC, SF, LA, and Chicago

- Was developing a card-linked offers program (similar to edo or Cartera)

- Had raised $46.1M from top-tier investors including Menlo Ventures and True Ventures

Why This Acquisition Makes Strategic Sense

- Closing the Loop: Bloomspot solved the critical challenge of tracking offer redemptions

- Relevance Engine: Their targeting algorithms outperformed traditional deal platforms

- Talent Acquisition: The team brought experience from Yahoo and other tech leaders

- Market Validation: Chase’s tests showed strong consumer receptivity to bank-offered deals

While Bloomspot faced challenges in the competitive local deals market, its acquisition by Chase represents a natural evolution for both companies. The integration, completed in early 2013, positioned Chase to become a major player in the card-linked offers space.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Men’s Solid Heather Tank

Image: Premium product showcase

Image: Premium product showcase

Professional-grade men’s solid heather tank combining innovation, quality, and user-friendly design.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!