By Semil Shah

Contributor, TechCrunch | Follow @semil

Bullpen Capital’s Foresight on the Series A Crunch

In a special edition of “In the Studio,” we sat down with Paul Martino and Rich Melmon, Managing Directors at Bullpen Capital, to discuss their early recognition of what’s now widely known as the “Series A Crunch.” Their insights, formed years before the trend became mainstream, reveal why Bullpen’s investment strategy remains ahead of the curve.

The Thesis That Predicted Today’s Funding Landscape

Back in 2009, Bullpen Capital identified a critical gap in early-stage funding:

- Rising Seed Deals, Stagnant Series A Rounds: The team noticed a widening disparity between the number of seed-funded startups and available Series A capital.

- Market Validation: Their recent report, “The Series A Cliff”, reinforces their original thesis with fresh data.

Unlike commentators who only theorized about the crunch, Bullpen acted—launching a fund specifically to bridge this gap.

What Bullpen Looks for in Startups

Martino and Melmon shared their investment criteria:

- Product-Market Fit: Seed-funded companies must demonstrate clear traction.

- Operational Roadmap: A viable plan to scale toward Series A readiness.

- Lean Execution: Startups that align with the efficiencies of modern, capital-light entrepreneurship.

The Shift in Silicon Valley’s Ecosystem

The conversation also highlighted broader trends:

- Geographic Movement: Entrepreneurial activity has shifted north to San Francisco, driven by cultural and logistical factors.

- YC’s Influence: The rise of Y Combinator and lean startup methodologies coincided with traditional VC firms over-raising funds, exacerbating the Series A bottleneck.

Why Timing Matters

This discussion couldn’t be more timely. As the early-stage investment climate tightens, Bullpen’s foresight offers a blueprint for navigating the “Series A Cliff.” Their proactive approach underscores the importance of adaptability in venture capital.

Watch the Full Interview: Dive deeper into Bullpen’s insights on “In the Studio.”

Semil Shah is an Entrepreneur-in-Residence at Javelin Venture Partners and a longtime TechCrunch contributor.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: SPANXshape™ Invisible Thong

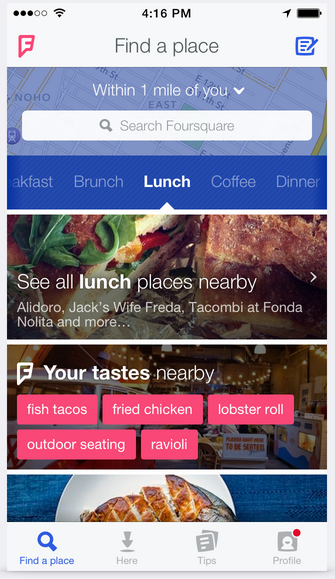

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted spanxshape™ invisible thong delivering superior performance and lasting value.

Key Features:

- Premium materials and construction

- User-friendly design and operation

- Reliable performance in various conditions

- Comprehensive quality assurance

🔗 View Product Details & Purchase

🛍️ Featured Product 2: SPANXshape™ ExtraOrdinary Supima® Cotton Boyshort

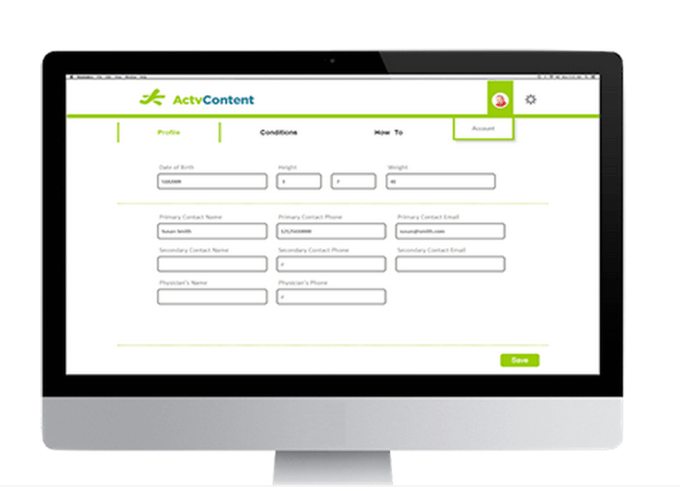

Image: Premium product showcase

Image: Premium product showcase

High-quality spanxshape™ extraordinary supima® cotton boyshort offering outstanding features and dependable results for various applications.

Key Features:

- Premium materials and construction

- User-friendly design and operation

- Reliable performance in various conditions

- Comprehensive quality assurance

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!