How Lead Edge Capital Attracts $5B from 700+ Investors by Shifting from VC to Control Deals

Mitchell Green, founder of Lead Edge Capital, has built an impressive investment firm managing $5 billion from over 700 high-net-worth individuals, including former CEOs of Xerox, Charles Schwab, and PayPal. His strategy? Steering clear of overvalued venture capital deals and focusing on control investments in overlooked, high-growth companies.

From Wall Street to $5B AUM: Mitchell Green’s Unconventional Path

Before launching Lead Edge in 2011, Green honed his skills in investment banking, as an analyst at Bessemer Venture Partners, and at a Tiger Management-backed hedge fund. Today, his firm’s portfolio includes stakes in Alibaba, Bumble, and Duo Security, but its real edge lies in targeting niche businesses like:

- Pacemate: A cardiac-monitoring software company in Sarasota, Florida

- Safesend: A tax-planning software firm in College Station, Texas

Why Investors Are Flocking to Lead Edge

Green attributes the firm’s appeal to its all-weather strategy:

- Control Deals: 33% of investments involve majority stakes (e.g., buying 54% of Pacemate)

- Geographic Diversification: Only 9% of portfolio companies are based in Silicon Valley

- Sourcing Edge: A team of 18 analysts screens 10,000+ companies annually, filtering for 8 key criteria

ByteDance and China: A Calculated Bet

Despite geopolitical risks, Lead Edge remains bullish on ByteDance (TikTok’s parent), even modeling scenarios where the U.S. bans the app. Green’s thesis:

“We can zero out the U.S. business and still expect 3-4x returns based on ByteDance’s 30% annual growth and 5x earnings multiple.”

The firm previously invested in Ant Group before its IPO was halted by Chinese regulators—a position it continues to hold.

Why Lead Edge Is Avoiding AI Hype (and Overpriced VC Deals)

Green is skeptical of first-generation AI startups, comparing their trajectory to the dot-com bubble:

- Costs Will Plummet: “AI will revolutionize the world, but adoption will take longer than expected.”

- Valuation Warnings: Avoids companies trading at 100-500x revenue with shaky retention rates

The Venture Market’s Fundamental Problem

“Too much money chasing too few overvalued companies. VCs echo each other, and social media amplifies the noise.”

Instead, Lead Edge focuses on bootstrapped businesses with proven revenue models, avoiding NAV loans and other financial engineering tactics favored by some VC firms.

Key Takeaways for Investors

- Control Over Hype: Lead Edge prioritizes operational influence in stable, growing companies

- Diversification Matters: 91% of investments are outside Silicon Valley

- Patience Pays: Willing to hold positions like Ant Group and ByteDance for long-term gains

- AI Caution: Believes most AI startups will fail as technology costs decline

Green’s approach—equal parts contrarian and disciplined—offers a blueprint for investors wary of frothy valuations and herd mentality in venture capital.

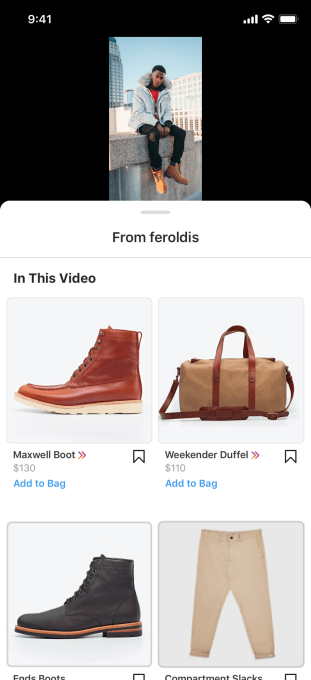

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: ALPINE PULLOVER SWEATER

Image: Premium product showcase

Image: Premium product showcase

Premium quality alpine pullover sweater designed for professional use with excellent performance and reliability.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

🛍️ Featured Product 2: ALYX AILANTHUS BOMBER JACKET

Image: Premium product showcase

Image: Premium product showcase

Advanced alyx ailanthus bomber jacket engineered for excellence with proven reliability and outstanding results.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

🛍️ Featured Product 3: AIR MORE UPTEMPO ’96

Image: Premium product showcase

Image: Premium product showcase

Premium quality air more uptempo ’96 designed for professional use with excellent performance and reliability.

Key Features:

- Premium materials and construction

- User-friendly design and operation

- Reliable performance in various conditions

- Comprehensive quality assurance

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!