How to Build a Fundraising Sales Funnel for Your First Startup Investment

Securing your first investment check requires more than just a great pitch—it demands strategic relationship-building and systematic execution. Milana Lewis, CEO and co-founder of music tech startup Stem, shares her proven framework for early-stage fundraising success.

The Power of Early Relationship Building

Milana’s journey began a decade before launching Stem, during her tenure at United Talent Agency (UTA). While evaluating tools for UTA’s clients, she identified a critical gap in financial management solutions for artists—an insight that would later shape Stem’s mission.

Her role at UTA Ventures, the agency’s investment arm, provided unexpected advantages:

- Exposure to high-profile investors like Gary Vaynerchuk and Scooter Braun

- Opportunities to cultivate authentic relationships

- A platform to share her entrepreneurial aspirations

“Start raising a year before you start raising,” Milana advises. “Build relationships and data points long before you need them.”

3 Key Strategies for Fundraising Success

1. Bring Investors Into Your Journey Early

Milana’s approach to investor relations:

- Shared regular updates about Stem’s development

- Sought advice during the ideation phase

- Maintained transparency about her entrepreneurial goals

This long-term engagement meant that when fundraising began, some investors required just a 15-minute conversation to commit.

2. Systematize Your Outreach

Milana’s disciplined process for each funding round:

- Create a Lead List: 100+ potential investors

- Discovery Phase: Track responses to key questions in a shared spreadsheet:

- Investment focus areas

- Recent portfolio additions

- Market opportunities they’re watching

- Typical check sizes

- Prioritize Prospects: Focus on investors with:

- Relevant stage focus

- Existing relationships

- Potential to attract other backers

- Create Urgency: Compressed 60-day timelines with back-to-back meetings in key cities

3. Transform Rejection Into Intelligence

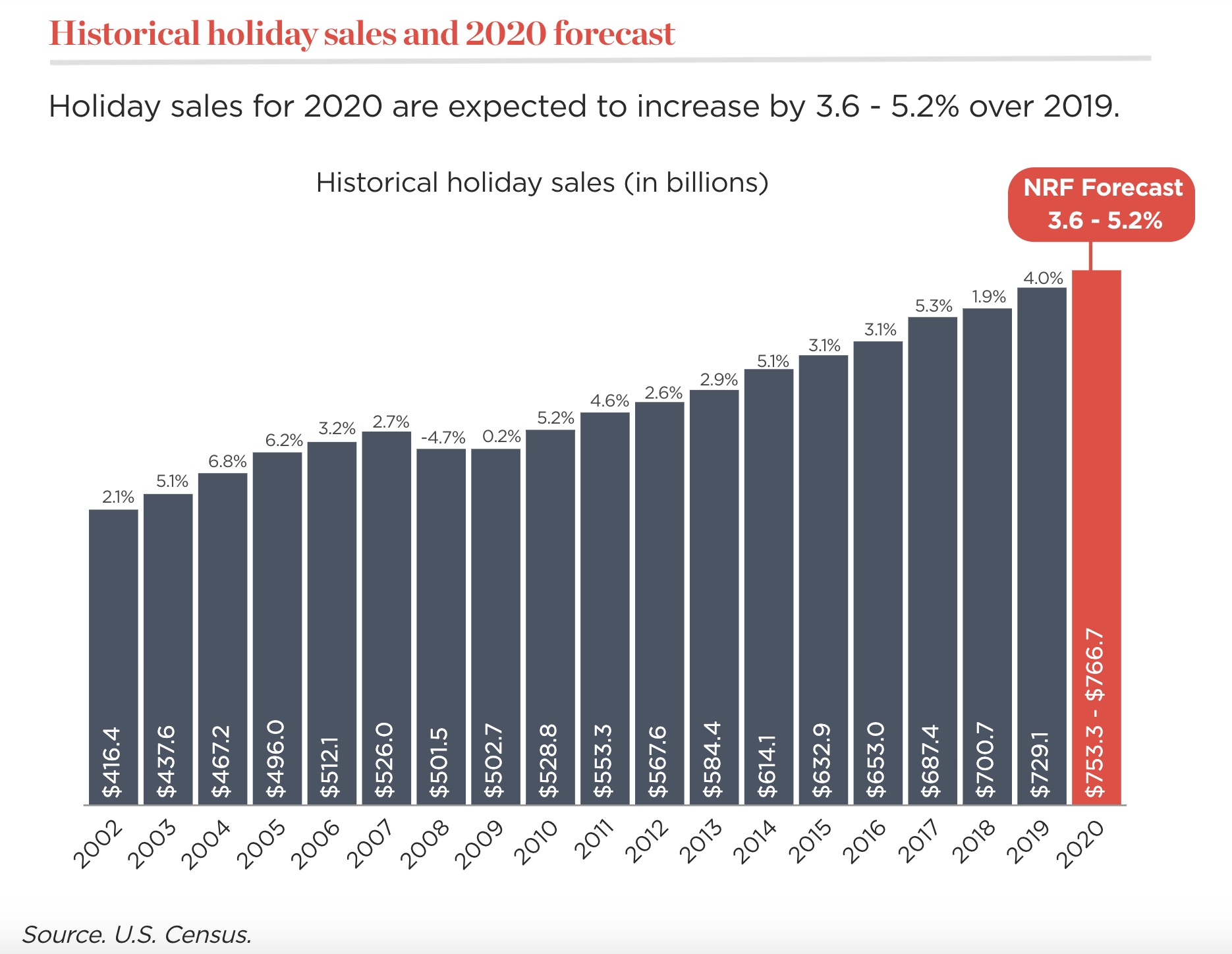

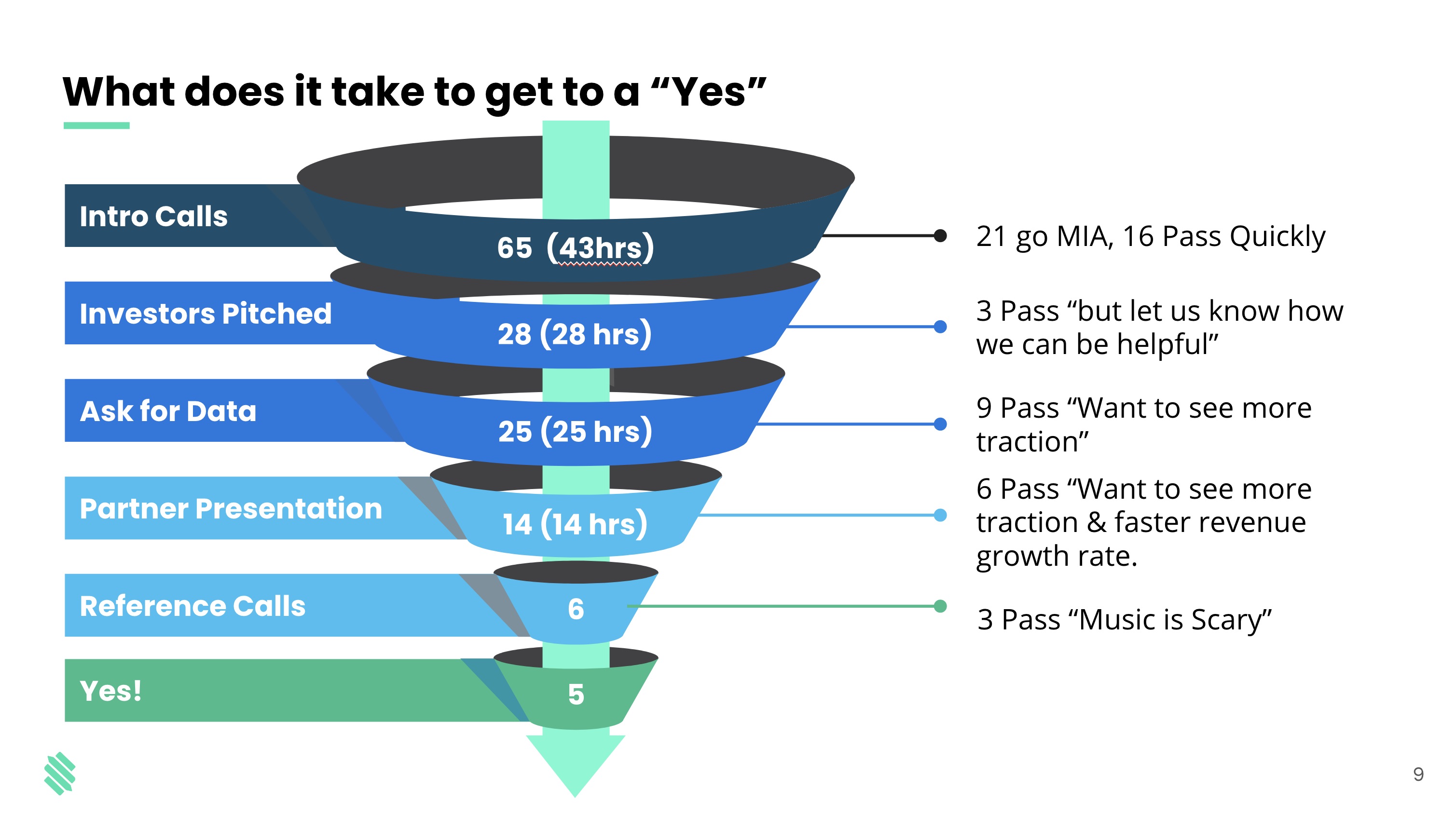

During Stem’s COVID-era fundraising round:

- Conducted 65 introductory calls

- 28 progressed to next stages

- 21 ghosted, 16 passed

Milana’s rejection protocol:

- Requested referrals from investors passing due to timing

- Gathered detailed feedback from declined offers

- Used insights to refine pitch materials and strategy

The result? A successful round closed with five committed investors.

Key Takeaways for Founders

- Start early: Investor relationships take years to cultivate

- Systematize everything: From lead tracking to meeting schedules

- Leverage rejection: Every \‘no\’ contains valuable data

- Create scarcity: Time-bound processes drive decisions

Image Credits: Nathan Beckord

Image Credits: Nathan Beckord

By approaching fundraising as a long-term relationship-building process rather than a transactional pitch, founders can significantly improve their chances of securing that crucial first check.