US Holiday E-Commerce Sales Poised for Major Growth

Key Forecasts Show Digital Shopping Boom

Leading retail analysts predict a significant surge in US online holiday sales despite ongoing pandemic challenges. According to new reports from the National Retail Federation (NRF) and eMarketer, e-commerce is driving overall retail growth while brick-and-mortar stores face declines.

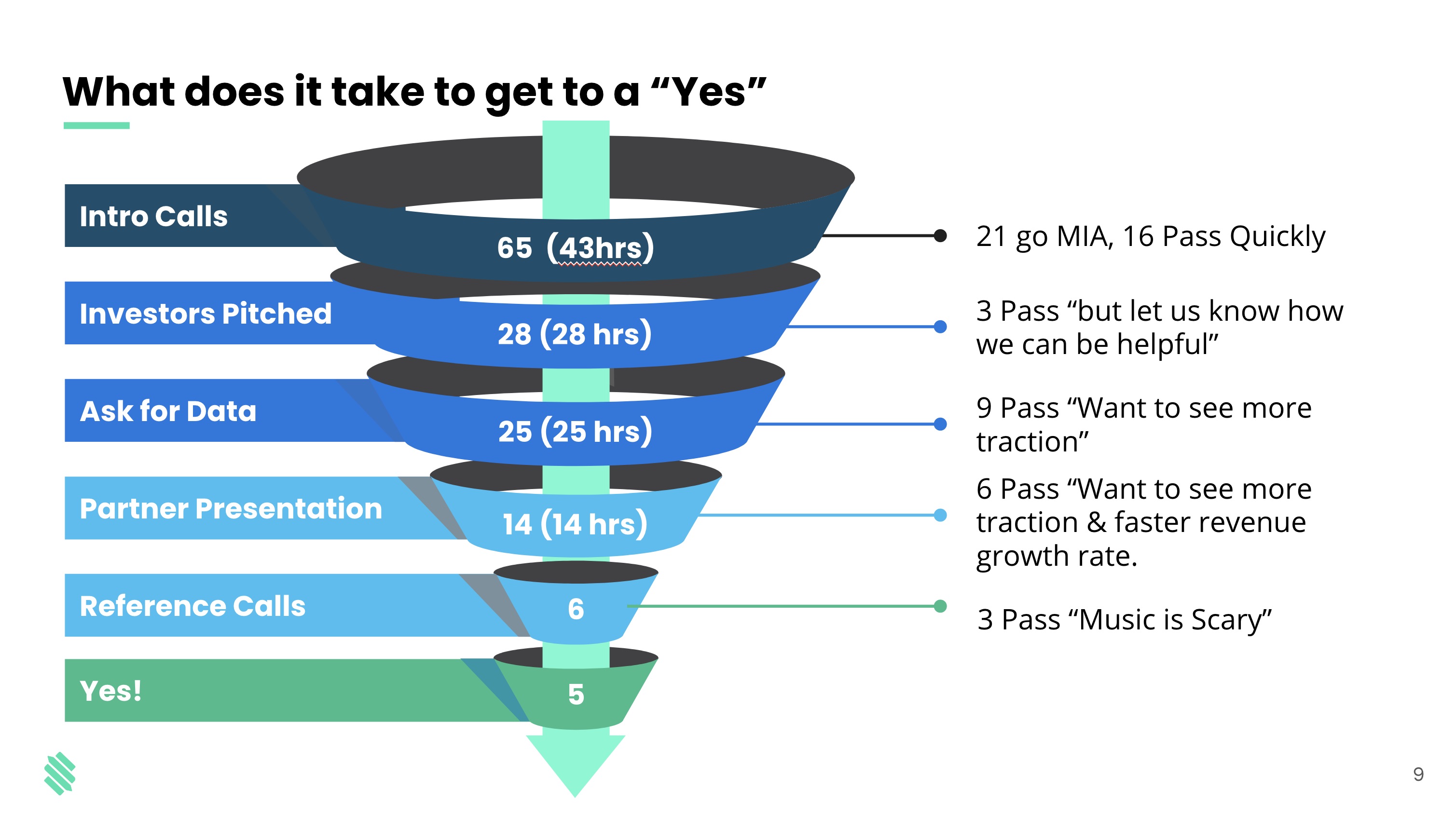

NRF’s Optimistic Outlook

The NRF forecasts:

- 3.6%-5.2% total holiday sales growth (Nov-Dec)

- \(755.3B-\)766.7B projected total sales

- 20%-30% increase in online/non-store sales (\(202.5B-\)218.4B)

“Consumers appear ready to spend more this season,” said NRF Chief Economist Jack Kleinhenz. “After a challenging year, many feel they deserve a better-than-normal holiday.”

Image: NRF holiday sales forecast

Image: NRF holiday sales forecast

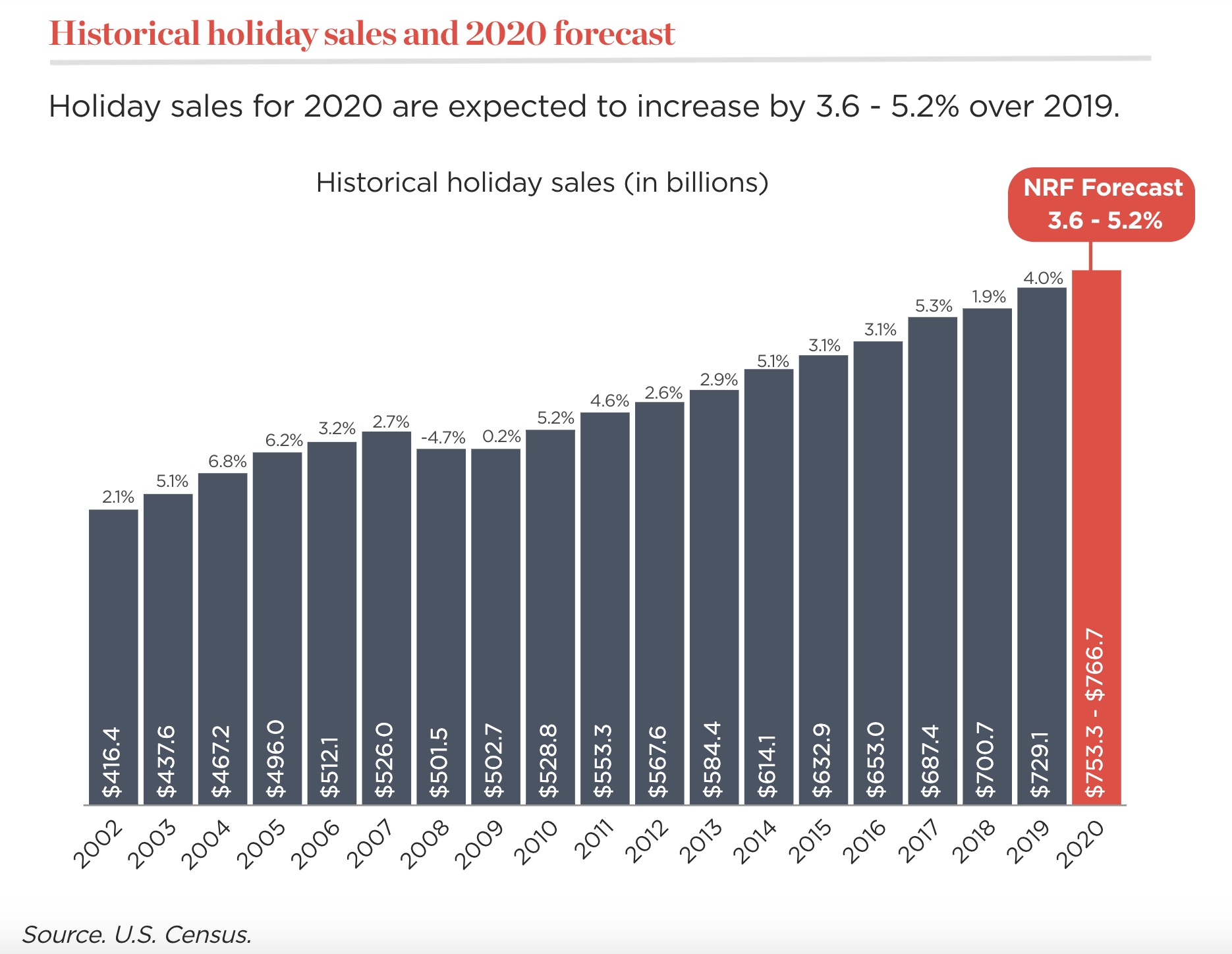

eMarketer’s More Conservative View

eMarketer projects:

- 0.9% total retail growth (lowest since tracking began)

- 35.8% e-commerce growth (highest on record)

- 4.7% decline in brick-and-mortar sales

Image: eMarketer retail projections

Image: eMarketer retail projections

Why the Discrepancy?

The variance stems from different calculation methods:

- NRF excludes auto, gas, and restaurant sales

- eMarketer includes auto/gas but excludes restaurants/travel

E-Commerce Trends Driving Growth

Key factors fueling digital sales:

- 36.7% YoY Q3 online sales growth

- 42% of consumers started holiday shopping early

- 10.6% October 2020 retail sales increase vs. 2019

Major retailers like Walmart and Target are benefiting from:

- Enhanced digital shopping experiences

- Flexible fulfillment options (ship-to-home, in-store pickup, curbside)

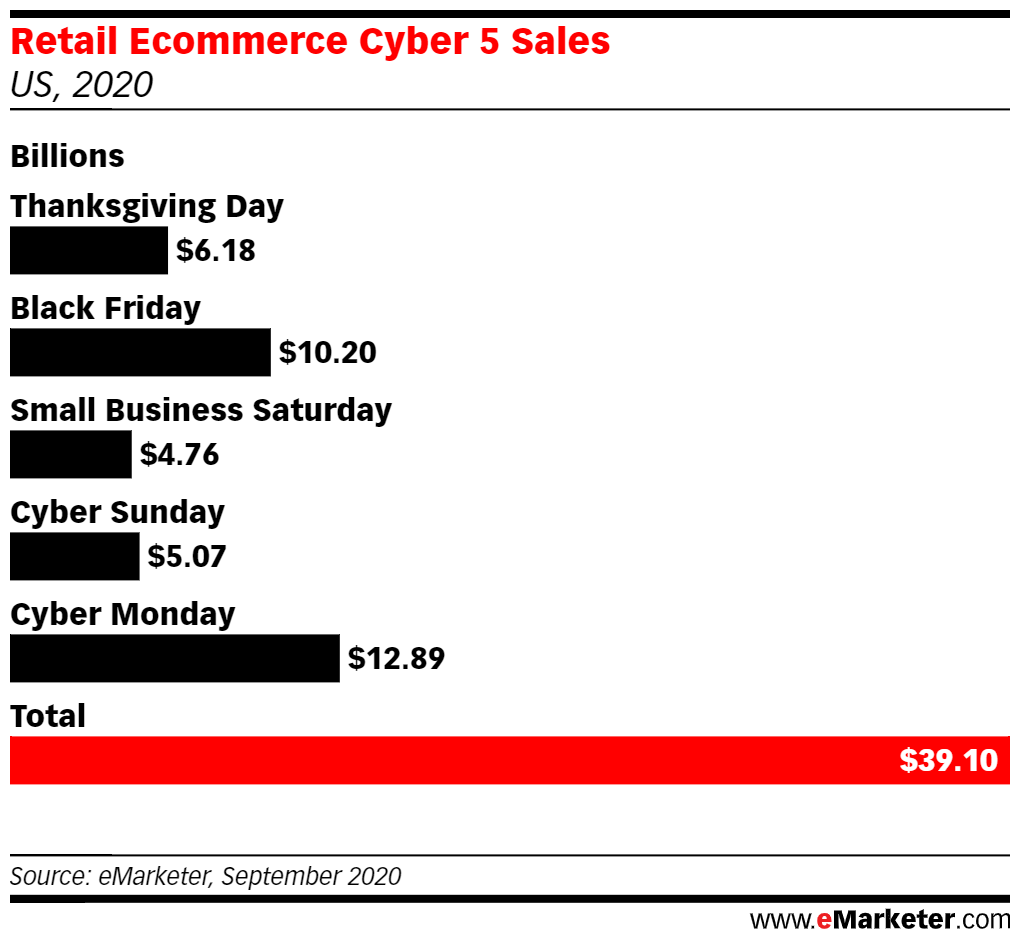

Holiday Shopping Day Projections

eMarketer predicts these top digital shopping days:

- Cyber Monday: $12.89B

- Black Friday: $10.20B

- Thanksgiving Day: 49.5% YoY growth (highest)

Image: eMarketer’s top shopping day projections

Image: eMarketer’s top shopping day projections

Mobile Shopping Boom

App Annie reports:

- 110M+ hours expected in shopping apps during Black Friday/Cyber Monday weeks

- 4h 20m average daily mobile usage (pandemic acceleration)

- 61M hours spent shopping during Prime Day week

Seasonal Employment Outlook

NRF expects:

- 475,000-575,000 seasonal hires

- Slightly below 2019’s 562,000 workers

- Earlier hiring due to accelerated shopping timelines

The Bottom Line

While forecasts vary, all indicators point to:

- Record e-commerce growth (20%-35% increases)

- Continued challenges for physical retailers

- Mobile dominance in digital shopping experiences

- Earlier, more spread-out holiday shopping patterns