India’s Early-Stage Startup Funding Gap: Why VCs Are Shifting Focus

While India’s startup ecosystem broke records with $14.5 billion in funding in 2019, a troubling trend has emerged: early-stage startups are struggling to secure capital. Despite the headline numbers, most investments are flowing to late-stage unicorns, leaving promising young companies in sectors like agritech fighting for attention.

The Funding Disparity in Numbers

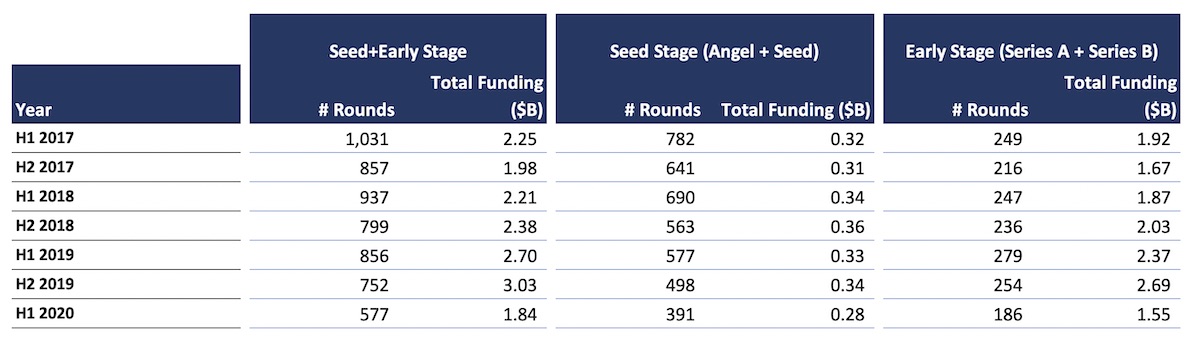

Recent data reveals a stark contrast in funding distribution:

- First Half 2020: Early-stage startups raised just $1.84 billion across 577 rounds (lowest in years)

- Second Half 2019: $3.03 billion across 752 rounds

- First Half 2019: $2.7 billion across 856 rounds

Series A and B startups face similar challenges, with funding dropping to \(1.55 billion (186 rounds) in H1 2020 from \)2.69 billion (254 rounds) in H2 2019.

Funding received by startups in India (Image: Tracxn)

Funding received by startups in India (Image: Tracxn)

Why Early-Stage Startups Are Being Overlooked

VCs acknowledge several systemic issues:

- Unicorn Obsession: Investors increasingly chase established startups with $100M+ funding

- Risk Aversion: Pandemic uncertainty has made VCs more cautious about untested models

- Sector Bias: Edtech and fintech dominate while other innovative sectors struggle

Karthik Reddy of Blume Ventures notes: “There’s an artificial skew toward unicorns. The funding funnel has sharpened dramatically.”

The Silver Lining: New VC Strategies Emerging

Several positive developments suggest change may be coming:

- Earlier Stage Participation: Traditional Series A/B investors are entering seed rounds

- Dedicated Programs:

- Sequoia’s Surge accelerator (50+ startups supported)

- Accel’s SeedToScale platform

- Big-Ticket Seed Rounds: Examples like epiFi (\(13.2M) and Uni (\)18.5M)

“When firms back seed rounds but skip Series A, it sends negative signals,” warns Rohan Malhotra of Good Capital. “The ecosystem needs consistent participation.”

The Stealth Mode Factor

Industry insiders reveal another dimension:

- Only ~33% of seed deals are publicly announced

- Many startups now operate longer in stealth mode

- True early-stage activity may be underreported

Pandemic’s Impact on Investment Psychology

The COVID-19 crisis has amplified risk aversion:

“When you see completely original ideas—especially untested models—the risk factor skyrockets,” explains one anonymous VC. “With limited funds, you must choose battles carefully.”

The Path Forward

While challenges persist, the ecosystem shows signs of maturation:

- More successful founders becoming angel investors

- Increased domestic capital participation

- Growing recognition of non-traditional sectors

As India’s startup landscape evolves, the hope is that funding will become more evenly distributed across stages and sectors—creating a healthier, more sustainable ecosystem for innovation.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Mørkegrå Arniesays: Blane Genser

Image: Premium product showcase

Image: Premium product showcase

Premium quality mørkegrå arniesays: blane genser designed for professional use with excellent performance and reliability.

Key Features:

- Cutting-edge technology integration

- Streamlined workflow optimization

- Heavy-duty construction for reliability

- Expert technical support available

🔗 View Product Details & Purchase

🛍️ Featured Product 2: Marine Arniesays: Fiona Genser

Image: Premium product showcase

Image: Premium product showcase

Advanced marine arniesays: fiona genser engineered for excellence with proven reliability and outstanding results.

Key Features:

- Cutting-edge technology integration

- Streamlined workflow optimization

- Heavy-duty construction for reliability

- Expert technical support available

🔗 View Product Details & Purchase

🛍️ Featured Product 3: Marine Arniesays: Cece Genser

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted marine arniesays: cece genser delivering superior performance and lasting value.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!