InDrive Launches $100M Venture Arm to Fuel Startups in Emerging Markets

InDrive, the innovative bid-based ride-hailing platform dominating Latin America and Asia, has unveiled New Ventures, a strategic mergers and acquisitions (M&A) division. The company plans to invest $100 million in high-potential startups across emerging markets over the next few years.

Strategic Expansion and Diversification

This bold move follows InDrive’s recent expansion into the U.S. market (South Florida) as the company works toward profitability. The venture arm aims to diversify revenue streams while capitalizing on favorable startup valuations in the current economic climate.

“We see great opportunities across our ecosystem,” said Andries Smit, VP of New Ventures. “With valuations stabilizing, now is the ideal time to invest in scalable startups that align with our mission.”

Target Markets and Investment Focus

InDrive—originally founded in Russia and now headquartered in the U.S.—will prioritize startups in regions where it already operates, including:

- Latin America

- Middle East & Africa

- Southeast Asia

- Central Asia

Smit emphasized InDrive’s unique ability to help “local gems” expand into new markets through strategic investments or acquisitions.

Key Investment Verticals

New Ventures will focus on two primary areas:

Ride-Hail Adjacencies

Startups in delivery services, intercity transport, or freight—sectors where drivers can diversify earnings. (InDrive recently acquired Master Delivery to bolster its offerings.)Horizontal Tech Solutions

Fintech, insurtech, or other technologies addressing pain points for InDrive’s 200M+ users (drivers and passengers).

Funding Strategy and Criteria

The $100M will be allocated annually from InDrive’s balance sheet, starting in 2024. Investments will target post-seed/Series A startups demonstrating:

- 2-3x year-over-year growth

- Strong unit economics

- Efficient customer acquisition and retention

Why This Matters

Portfolio companies gain access to:

- InDrive’s global user base (45+ markets, 700+ cities)

- Go-to-market expertise

- Cutting-edge technology

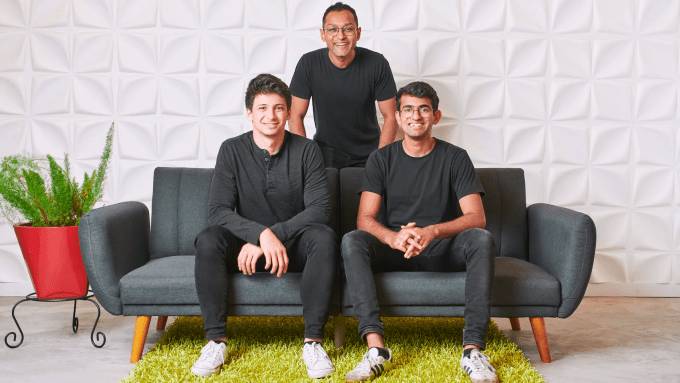

Leadership and Vision

Andries Smit, who leads New Ventures, brings decades of experience from Morgan Stanley, Aviva, and Stryber (a corporate venture builder). His background in M&A and scaling businesses aligns with InDrive’s growth ambitions.

Beyond Ride-Hailing

Since its \(150M Series C (2021 valuation: \)1.25B), InDrive has expanded into:

- Freight delivery

- Task assistance

- Employment search

This venture arm solidifies InDrive’s evolution from a ride-hail disruptor to a multifaceted mobility and tech powerhouse.

Updated with additional insights from InDrive and Andries Smit.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: ACO Plus Linear ShowerChannel

Image: Premium product showcase

Image: Premium product showcase

Advanced aco plus linear showerchannel engineered for excellence with proven reliability and outstanding results.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!