Why the 4-Year Founder Vesting Model is Outdated in Today’s Startup Landscape

The Shift Toward Longer Vesting Schedules

In a recent investment, we encountered a founding team that voluntarily extended their vesting period beyond the traditional four-year standard. Their reasoning? “With companies now taking 7-10 years to reach exit, founders should align their vesting with this timeline.”

This perspective highlights a critical flaw in startup equity structures: the four-year vesting schedule often works against founders’ best interests, sometimes with devastating consequences for their companies.

The Growing Awareness Among Experienced Founders

An increasing number of founders—particularly repeat entrepreneurs—are recognizing this issue. Many arrive at this realization after experiencing painful co-founder separations in previous ventures. These seasoned founders share several key characteristics:

- They view themselves as the company’s true builders

- They expect to remain with the company long-term

- They’re proactively designing smarter equity structures

The Historical Context of 4-Year Vesting

Origins in 1980s Corporate America

The four-year vesting standard traces back to pre-401(k) era tax incentives that encouraged five-year vesting for corporate pension plans. Startups adopted four-year vesting as a competitive differentiator when offering stock instead of pensions.

Why This Model is Obsolete

- Extended Time to Exit: The median exit timeline has doubled from 4 years (1999) to 8 years (2020)

- Misaligned Incentives: Short vesting periods create structural risks for growing companies

- Modern Startup Realities: Today’s funding environment and growth trajectories demand fresh approaches

The Dangers of Short Vesting Periods

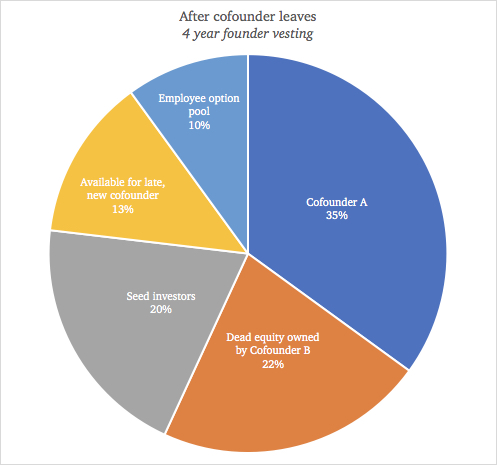

The Dead Equity Problem

Consider this common scenario:

- Two co-founders split equity 50⁄50 with four-year vesting

- After 2.5 years, one founder departs

- The departing founder retains 22% equity (“dead equity”)

This creates multiple challenges:

- Demoralization: Remaining founders resent the imbalance

- Talent Acquisition: Limited equity remains for new hires

- Funding Hurdles: VCs often avoid startups with significant dead equity

The Case for Extended Vesting Schedules

Benefits of 8-Year Vesting

- Fairer Distribution: Departing founders retain smaller equity stakes (e.g., 11% instead of 22%)

- Improved Cap Table Health: More equity available for talent and funding

- Better Alignment: Matches modern startup growth timelines

Implementation Considerations

- Ideal Timing: Best established at incorporation, but can be modified later with unanimous consent

- Flexible Approaches: Founders can choose schedules (4, 6, or 8 years) that fit their specific situation

- Employee Vesting: Can remain at 4 years to stay competitive in hiring markets

Key Takeaways for Founders

- Evaluate Your Timeline: Consider that building significant value typically takes 8+ years

- Design for the Long Haul: Structure vesting to support the company through its entire growth journey

- Learn from Experience: Many repeat founders now opt for longer vesting periods

- Maintain Flexibility: While extended vesting often makes sense, choose what works for your team

As startup ecosystems evolve, so too must our approaches to equity distribution. Founders who thoughtfully design their vesting schedules position their companies—and themselves—for greater success in today’s extended growth cycles.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Yasceline HW Midi Skirt – Black

Image: Premium product showcase

Image: Premium product showcase

Professional-grade yasceline hw midi skirt – black combining innovation, quality, and user-friendly design.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

🛍️ Featured Product 2: Nanacc Piping Wide Pant – Mink

Image: Premium product showcase

Image: Premium product showcase

Advanced nanacc piping wide pant – mink engineered for excellence with proven reliability and outstanding results.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

🛍️ Featured Product 3: Mercy-Ula HW Mini Wool Skirt – Dark Grey Melange

Image: Premium product showcase

Image: Premium product showcase

Premium quality mercy-ula hw mini wool skirt – dark grey melange designed for professional use with excellent performance and reliability.

Key Features:

- Professional-grade quality standards

- Easy setup and intuitive use

- Durable construction for long-term value

- Excellent customer support included

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!