European Startup Funding Faces Steep Decline in 2023

New data from VC firm Atomico reveals a dramatic slowdown in European startup investment, with funding expected to reach just $45 billion in 2023 — half of 2022’s $85 billion total. The findings come from Atomico’s annual State of European Tech report, which highlights how economic headwinds are reshaping the venture capital landscape.

Key Findings: A Market Correction Underway

- Funding down across all stages: Seed through Series C rounds have declined significantly

- Unicorn creation slows: Only 7 new $1B+ startups expected vs. 48 in 2022 and 108 in 2021

- Later-stage squeeze: Growth-stage companies face the sharpest valuation drops

Image Source: Atomico Report

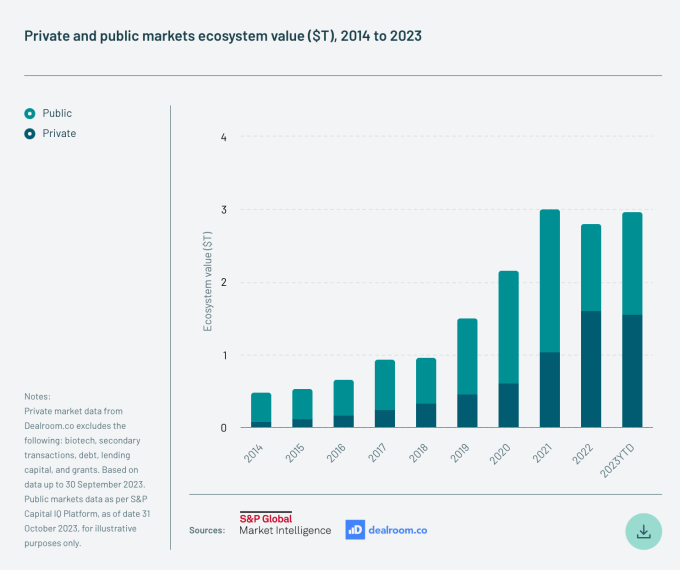

Context: Returning to Pre-Boom Levels

While the numbers appear bleak, Atomico suggests 2021-2022 were anomaly years fueled by:

- Pandemic-driven tech adoption surges

- Exceptionally low interest rates

- Overflowing LP capital needing deployment

“Viewed against a longer timeline,” the report notes, “current figures represent a return to more sustainable growth patterns.”

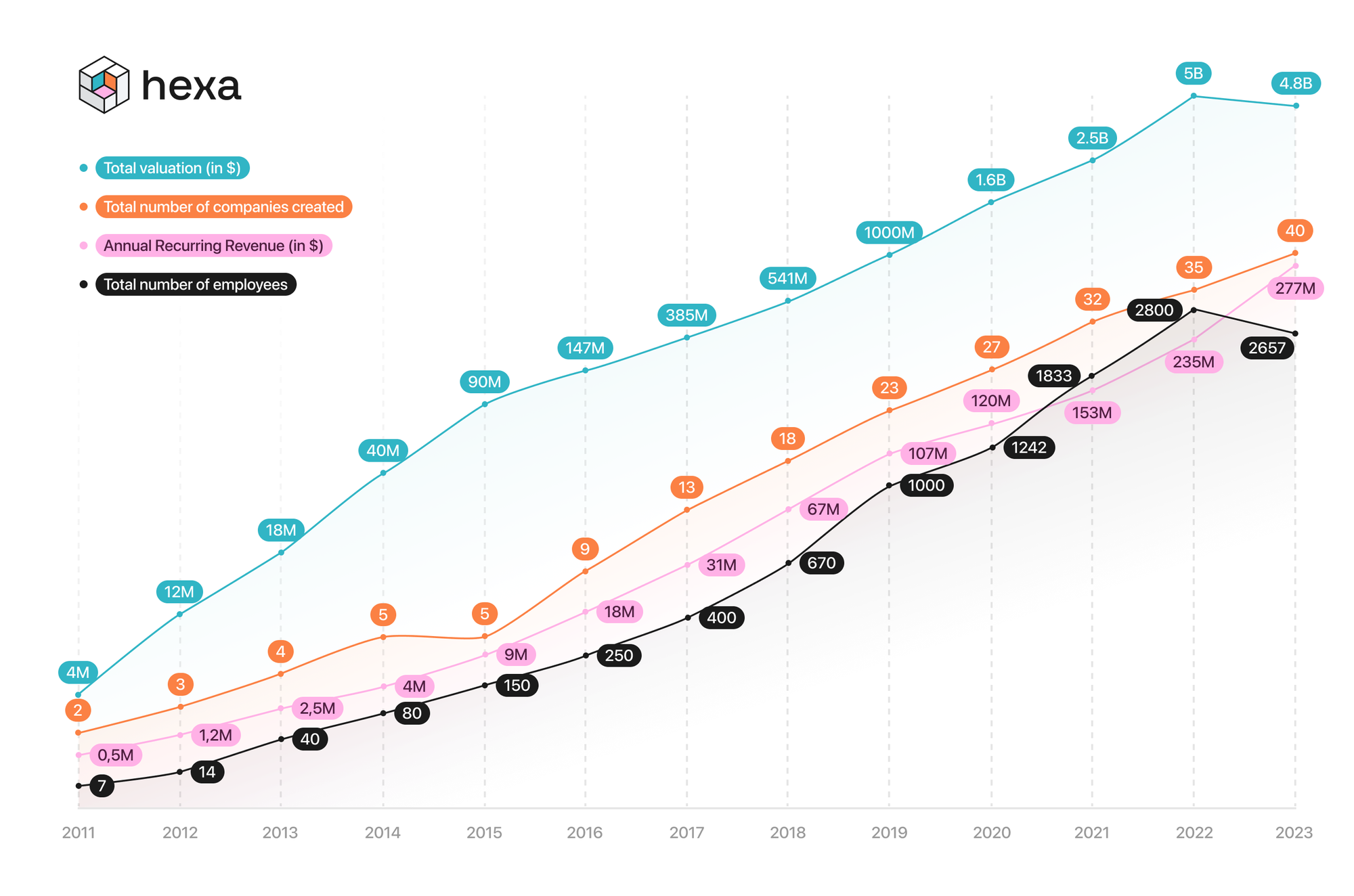

Silver Linings in the European Tech Ecosystem

- $3 trillion valuation milestone: Combined public/private tech company values rebounded to 2021 levels

- Healthy funding distribution: 72% of follow-on rounds were flat or up rounds (vs. down rounds)

- Strong new venture creation: Early-stage startups continue entering the market

Image Source: Atomico Report

Notable Trends Reshaping Investment

The Crossover Investor Exodus

- Mega-rounds ($100M+) dropped to just 36 in 2023 vs. hundreds in 2021-2022

- Tiger Global-style investors made only 4 European deals this year

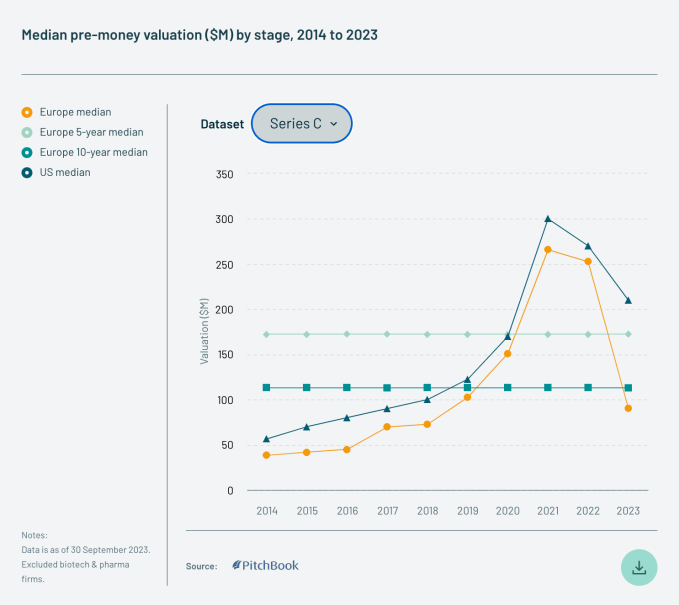

Valuation Reality Check

- European startups now valued 30-60% lower than US counterparts

- Series C rounds seeing steepest declines

- US Seed rounds (\(11.5M median) still double Europe's (\)5.7M median)

Image Source: Atomico Report

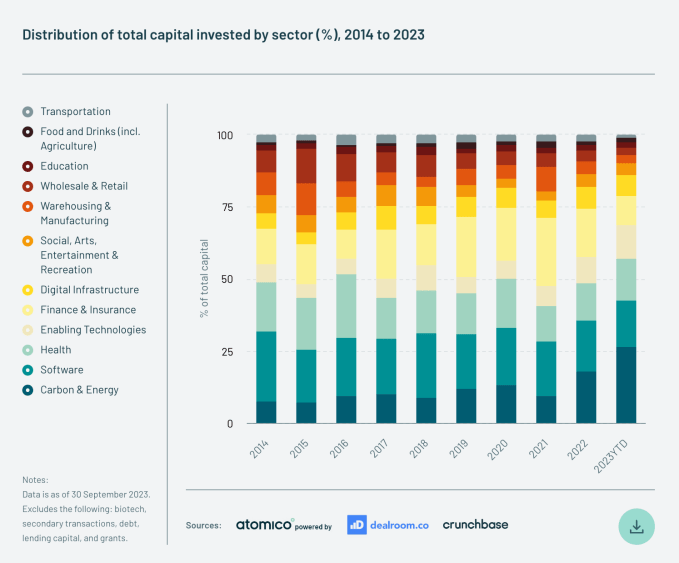

Climate Tech Emerges as Investment Leader

Despite AI hype, Carbon & Energy sectors captured:

- 27% of all European tech investment in 2023 (double 2022’s share)

- More funding than traditional powerhouses like FinTech and Software

“This represents both a green transition acceleration and fintech slowdown,” the report states.

Image Source: Atomico Report

Methodology Note

Atomico’s findings combine proprietary surveys with data from Dealroom, CrunchBase, and other third-party sources, offering one of the most comprehensive views of European tech trends.

Correction: An earlier version stated \(42B; the correct 2023 projection is \)45B.

📚 Featured Products & Recommendations

Discover our carefully selected products that complement this article’s topics:

🛍️ Featured Product 1: Boss Alloy Bar (31.8) Black – 44cm

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted boss alloy bar (31.8) black – 44cm delivering superior performance and lasting value.

Key Features:

- Industry-leading performance metrics

- Versatile application capabilities

- Robust build quality and materials

- Satisfaction guarantee and warranty

🔗 View Product Details & Purchase

🛍️ Featured Product 2: SIRUI SVS60 Rapid System One-Step Height Adjustment Video Tripod Kit

Image: Premium product showcase

Image: Premium product showcase

Carefully crafted sirui svs60 rapid system one-step height adjustment video tripod kit delivering superior performance and lasting value.

Key Features:

- Cutting-edge technology integration

- Streamlined workflow optimization

- Heavy-duty construction for reliability

- Expert technical support available

🔗 View Product Details & Purchase

💡 Need Help Choosing? Contact our expert team for personalized product recommendations!